De-Lululemon

Lululemon, the Canadian athleisure brand, released their Q4 2024 results last week, reporting a revenue of $3.6 billion, up 13% year over year, and an operating income of $1 billion, up 14% year over year. For the full year, net revenue in the Americas increased by 4%, while net revenues from their international segment surged by 34%. The international segment accounted for 25% of Lululemon’s total sales for the year, while the US accounted for 61%.

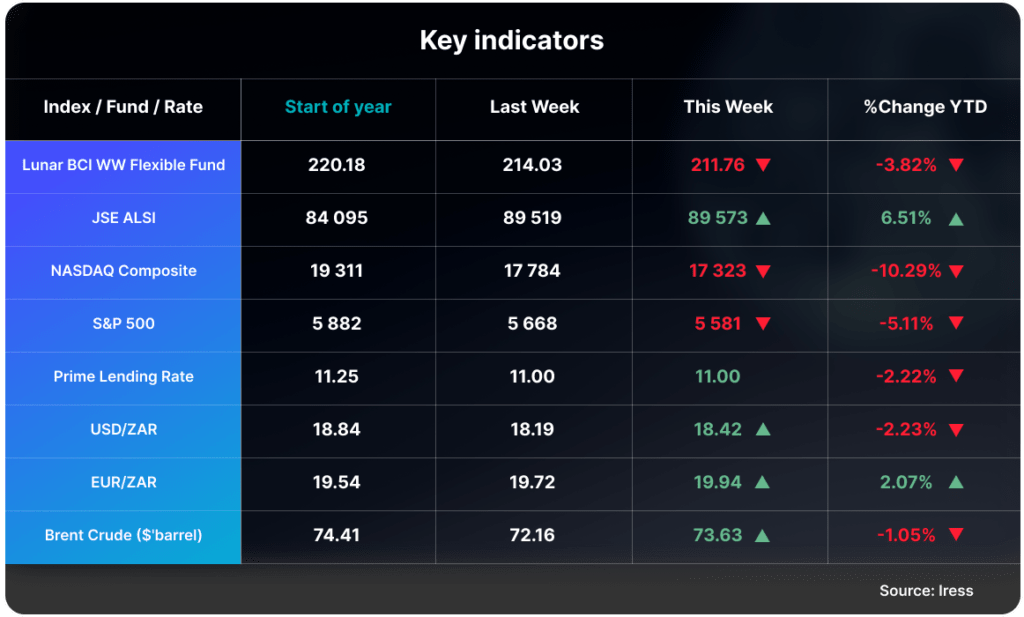

Despite these strong results, management indicated signs of a more frugal consumer. Over the past three years, consumers have faced high inflation, and recently the looming threat of tariffs on the US’s trading partners could potentially decrease Lululemon’s gross margin. Year-to-date, Lululemon’s stock price has decreased just over 23%.

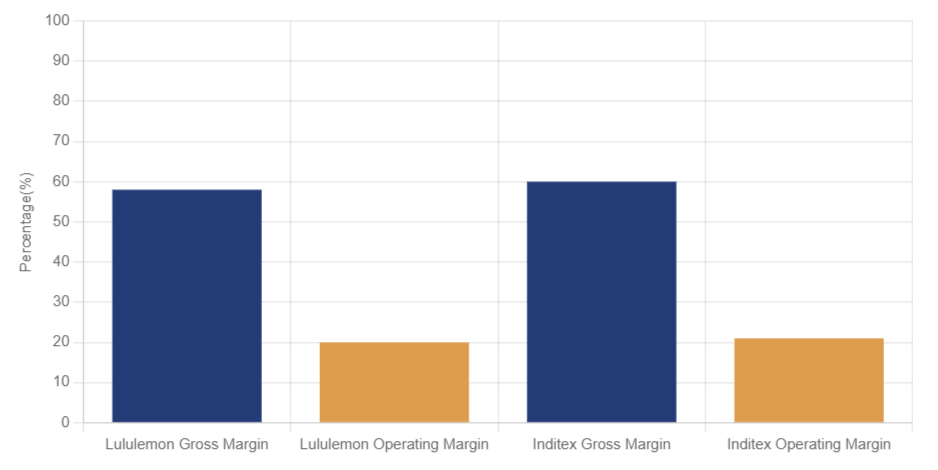

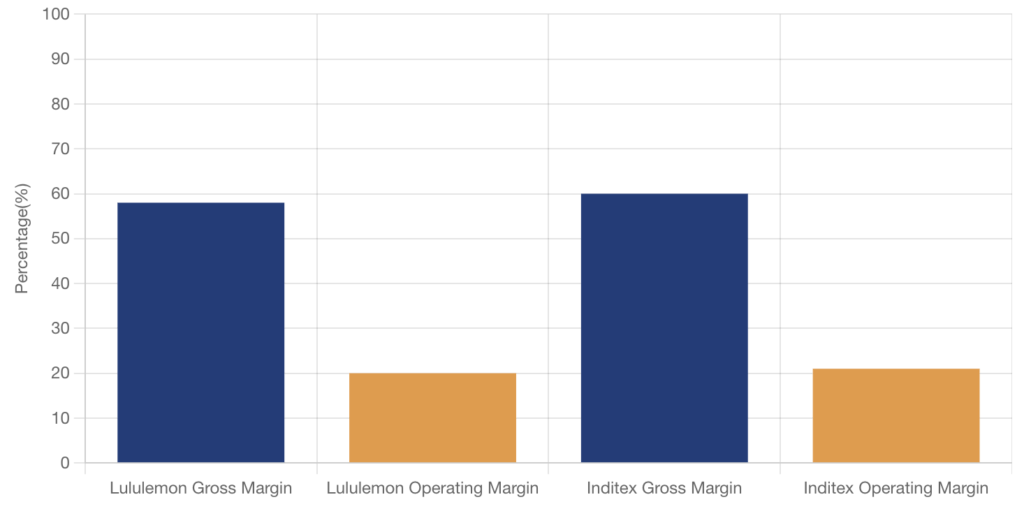

Known for selling $100 yoga pants, Lululemon recorded a relatively high gross margin of 60.4% for the most recent quarter. A high gross margin often allows a company to handle sudden increases in input costs without necessarily having to increase the prices of their products suddenly.

However, Lululemon is in a challenging position. Last year, they released a collection of products that didn’t resonate with US consumers. A company that prices its goods extremely high but fails to deliver on its original appeal to its customers, even the most loyal, could easily lose them to competitors offering similar products at lower prices. It is then extremely difficult to win those customers back.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.