Adobe is a digital-media company that creates and sells products and tools that are primarily suited towards the creative economy. Their products include Photoshop and Lightroom, which are used to alter images, Premiere Pro, which is the standard video editing tool, and Adobe Document Reader, which allows people to view and export a standardized version of a digital document. There are free versions of their products, but Adobe makes its money from charging users a subscription fee to access all the products’ features.

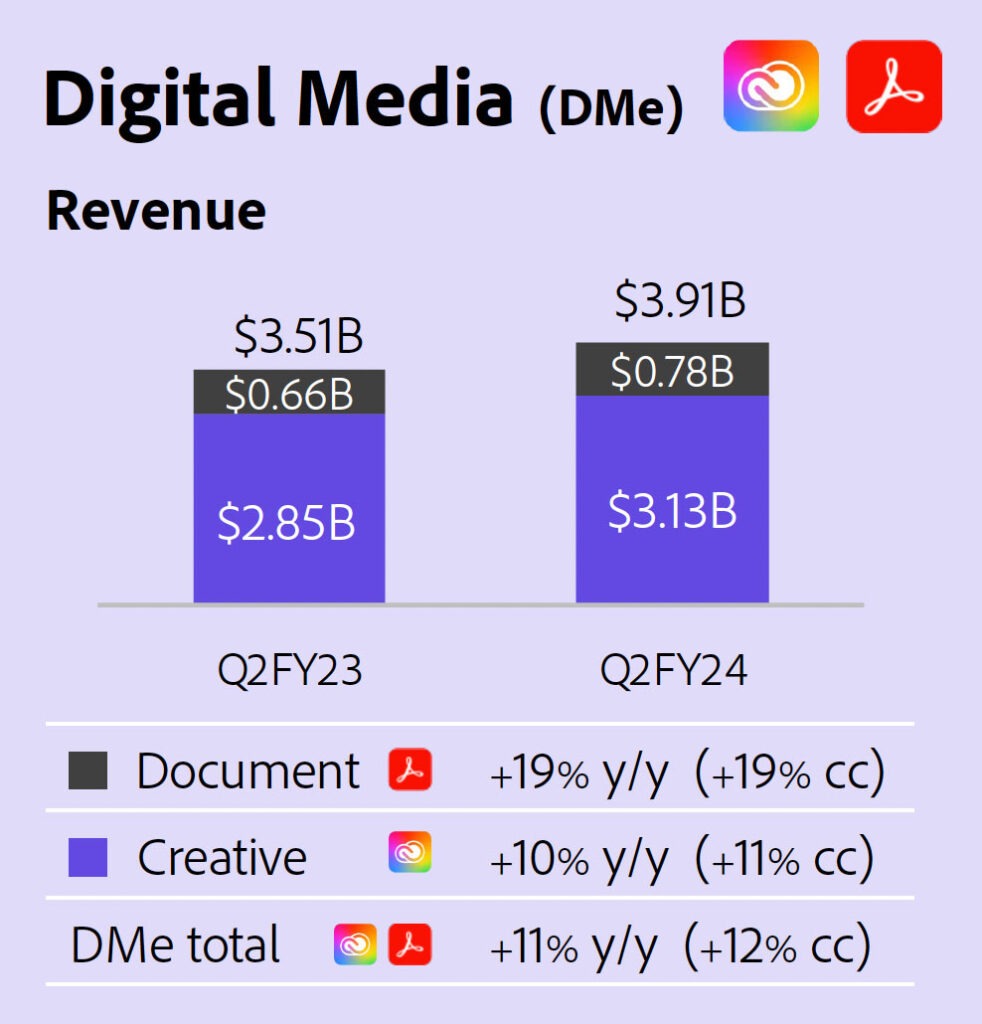

Two weeks ago, Adobe released their Q2 2024 results. Revenue for the quarter was $5.31 billion, up 10% year on year. And operating income was $1.89 billion, up 16% year on year. The table below is a snapshot from Adobe’s earnings slide, which shows their core driver of revenue: Digital Media (DMe). The Creative segment within DMe accounted for just under 59% of their total revenue this quarter. Creative grew just under 10% year on year – in line with their revenue growth.

Despite many of Adobe’s products being industry standard tools, they are facing an increasing number of headwinds from both competitors and regulators.

In 2022, Adobe agreed to buy Figma (an interface design tool) for $20 billion. At the time, the deal placed an astronomical 50x revenue valuation on Figma. The deal faced regulatory scrutiny in the EU and was therefore cancelled before it could be completed. Adobe had to pay Figma a cancellation fee of $1 billion. Adobe is now being sued in the US, as the Federal Trade Commission (FTC) claims that Adobe makes it too difficult for users to unsubscribe from their products.

Despite Adobe adding generative AI layers to their products, they are facing intense competition from the likes of Microsoft-backed OpenAI. OpenAI has many tools that directly compete with Adobe’s tools, allowing people to generate and edit texts and images using generative AI.

Adobe, once a gold standard, could be one of the first victims in the new generative AI world.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.