Lunar Capital Quarterly Investment & Performance Review – 30 June 2025

Lunar Capital Quarterly Investment & Performance Review – 30 June 2025 Read More »

Sabir provides an update of the Funds’ performance and how Lunar Capital is investing in the current environment.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.

Lunar Capital Quarterly Investment & Performance Review – 30 June 2025 Read More »

In 2011, a 9.0 magnitude earthquake off the coast of Tohoku, Japan triggered a tsunami with waves over 15 meters high. The tsunami overwhelmed the Fukushima Daiichi Nuclear Power Plant, operated by Tokyo Electric Power Company (TEPCO), flooding critical infrastructure and disabling backup generators essential for cooling the reactors. This led to core meltdowns in three of the plant’s six reactors. A 20-kilometre exclusion zone was established around the site, and the disaster was rated Level 7 on the International Nuclear Event Scale—the highest rating, matching the severity of the Chernobyl disaster.

The immediate aftermath of Fukushima had a profound impact on the global nuclear energy landscape. Uranium prices dropped sharply as demand for enriched uranium declined.

Many countries tightened regulations around the construction of new nuclear plants, and public sentiment shifted toward caution. In the United States, only three reactors have been built since 2011. The most recent additions—two reactors in Georgia completed in 2023 and 2024—saw costs soar past $30 billion, dampening enthusiasm for future projects. Despite ambitions from the Trump administration to expand nuclear capacity, no new reactors are currently under construction in the U.S.

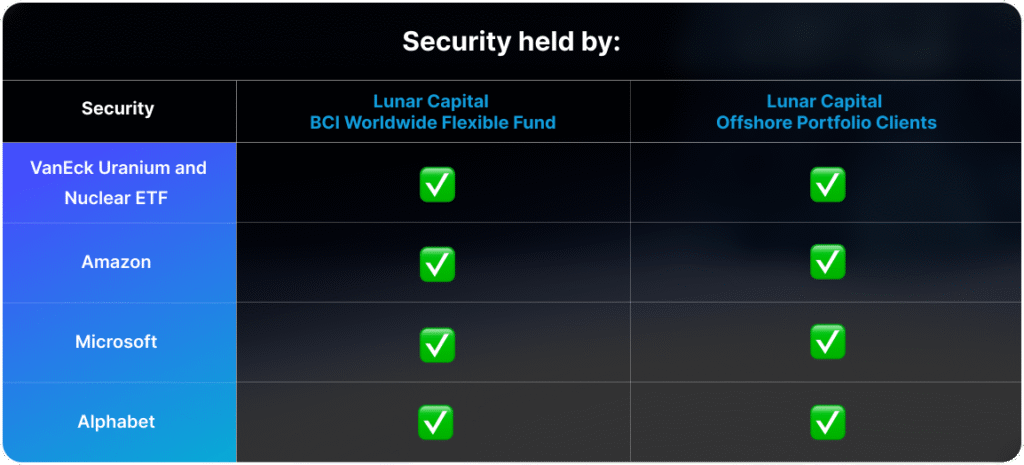

While the disaster initially led to a surplus of uranium in the market, that surplus is now dwindling. Supply constraints are emerging due to the high costs of developing new uranium facilities and the approaching expiration of several nuclear operating licenses over the next decade. As a result, uranium prices have been rising significantly. Technology improvements in nuclear energy reactors, using modular designs are making the lead times to develop nuclear energy plants shorter; creating additional attractiveness of nuclear energy solutions.

At the same time, demand for clean and stable energy sources is accelerating—particularly from Big Tech companies. Firms like Amazon, Microsoft, and Alphabet are investing heavily in AI infrastructure, which requires vast amounts of clean and stable power. To meet these needs, they’ve signed long-term agreements with nuclear power providers to supply energy to their data centres. As AI continues to expand, so too does the demand for a clean, stable energy source.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.

Valuing a company involves a significant amount of estimations, centred around what will future cash flows be. Key questions include: Will the company be able to significantly grow its sales? What future costs should we anticipate? Does the company possess durable competitive advantages that can sustain its cash flow over time? Ultimately, investors must decide what they’re willing to pay today for the possibility of future earnings.

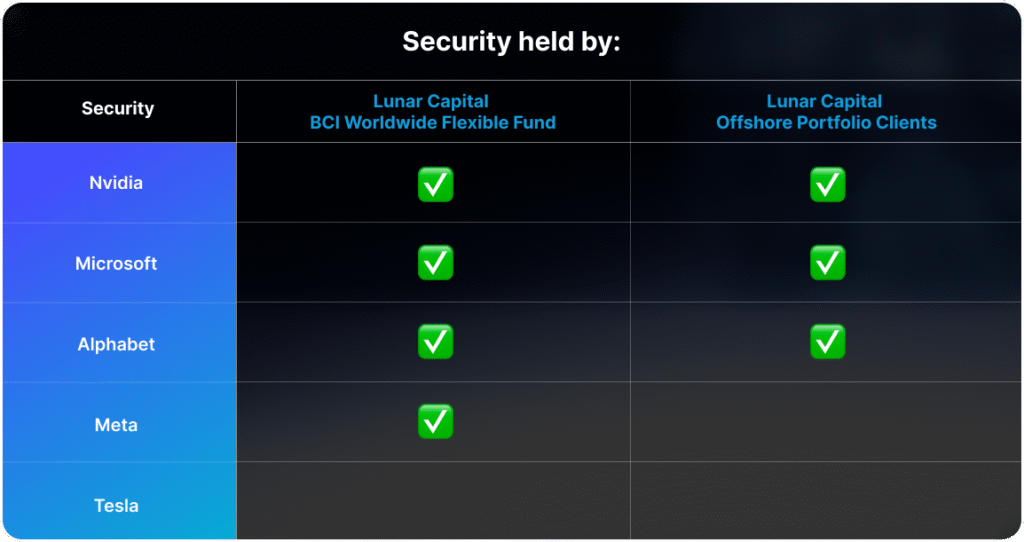

Tesla presents a particularly challenging case for valuation. The company currently trades at a price-to-earnings (P/E) ratio of around 182. This means that, at its current earnings level, it would take 182 years for an investor to recoup their investment through profits alone—a figure that underscores what some people in the market think is fair value for the company.

Typically, a high P/E ratio suggests rapid sales growth. Tesla’s core business is the manufacturing and sale electric vehicles (EVs), but recent data shows a troubling trend. EV sales for Tesla have declined for two consecutive quarters. In its most recent quarter, Tesla delivered 384,112 vehicles—down 13% compared to the same period last year. In Europe and the UK, deliveries fell to 13,863 vehicles, a 28% year-over-year drop. This marks the fifth straight quarter of declining sales.

This weakness can largely be attributed to two factors:

Tesla is betting that its next major growth opportunity is autonomous vehicles. The company has begun testing its robotaxi service in Austin, Texas, with a limited number of vehicles—each currently accompanied by a Tesla employee in the passenger seat for safety. For this initiative to scale and become profitable, Tesla would need to prove that their vehicles are safe to both potential passengers and regulators soon. Tesla also needs the proceeds from its EV business to be able to scale the robotaxi division. This can be extremely difficult when sales for the EV division are falling.

Tesla has a history of defying expectations and overcoming adversity. Can they do it again?

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.

Tesla – Better unMusked Read More »

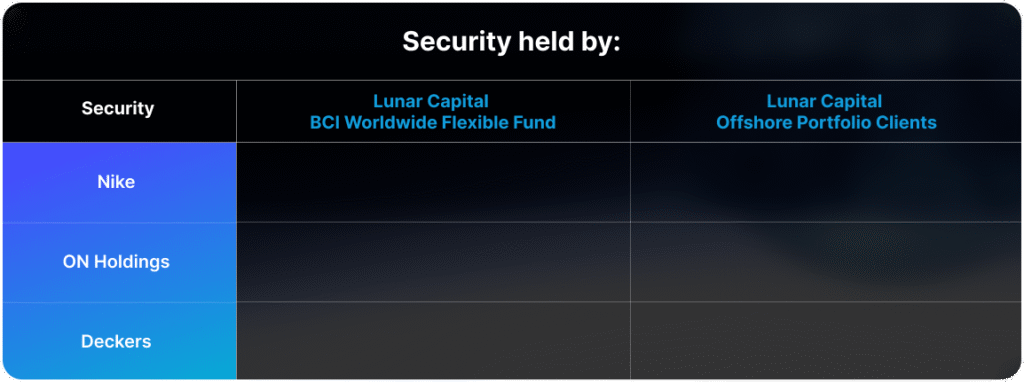

The athletic and athleisure industry is fiercely competitive and highly fickle. Consumers today have more choices than ever, and brands are battling on multiple fronts—price, style, and performance.

Nike recently released its Q4 2025 earnings report, revealing a challenging quarter. Revenue fell to $11.1 billion, a 12% decline year-over-year. Gross margin dropped to 40.3%, down from 44.7% in the same quarter last year. Most notably, net income plummeted to $0.2 billion, marking an 86% decrease compared to the previous year.

Back in 2017, Nike began shifting its strategy toward direct-to-consumer (DTC) sales, focusing on its own retail stores and online platforms. The goal was to gain greater control over the customer experience and eliminate the fees paid to wholesale partners, thereby boosting profit margins. As part of this strategy, Nike even terminated contracts with several wholesalers.

During the COVID-19 pandemic, Nike leaned further into lifestyle and athleisure products, capitalizing on the surge in online shopping and the shift in consumer behaviour. At the time, the strategy appeared successful—Nike was well-positioned as consumers stayed home and sought comfortable, stylish apparel.

However, the post-pandemic landscape presented new challenges. As consumers returned to physical stores and resumed more active lifestyles, Nike struggled to meet demand in key areas. Its products were no longer widely available through wholesale channels, and the brand had pivoted away from performance-focused gear. This opened the door for competitors like Hoka and On, who gained market share by catering to athletes and sport-specific needs.

In response, Nike is now working to reverse its fortunes. The company has begun rebuilding relationships with wholesale partners and brought back veteran executive Elliot Hill. Hill emphasized the need for Nike to return to its roots—designing high-performance footwear and gear for athletes.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.

Nike – Lifestyle or Performance Read More »

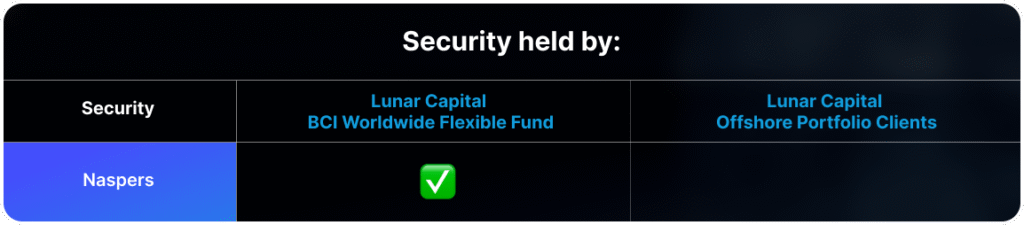

Naspers, South Africa’s largest company by market capitalisation, began its journey in the print media industry. It later expanded into pay-TV, launching M-Net, which became a household name across the continent. However, the company’s most transformative move came in 2001, when it acquired a 46.5% stake in Tencent, the Chinese social media and gaming giant.

Tencent operates two of China’s most popular social platforms: Weixin and WeChat. These multifunctional apps allow users to chat, shop online, and make payments—all within a single ecosystem. As of its latest results, Tencent reported 1.4 billion users across these platforms, with the vast majority based in China.

Over the years, Naspers has gradually reduced its stake in Tencent. In June 2022, it held 28.5%, and as of its most recent financial report, that figure now stands at 23.5%. The rationale behind this sell-down is to narrow the gap between Naspers’ market valuation and the net asset value (NAV) of its holdings. Holding companies often trade at a discount to NAV, and Naspers is no exception. According to the company, its NAV per share is R8,473.50, while its share price on 20 June 2025 was R5,235.40—reflecting a 38% discount.

Proceeds from the Tencent stake reduction have been used to expand Naspers’ e-commerce footprint. The company is focusing on lifestyle e-commerce businesses across Latin America, India, Europe, and South Africa. In the past 12 months, Naspers invested $7.8 billion in mergers and acquisitions, while divesting $2.6 billion from underperforming assets, including its stake in Superbalist. New management seem to be making good progress on its e-commerce businesses, the latest results show most of these businesses being cash flow and earnings positive.

However, this strategy is not without risk. Selling down a high-performing asset like Tencent to fund new ventures presents a significant challenge: replicating such outsized returns is notoriously difficult. Tencent has been a once-in-a-generation success for Naspers, and finding the next equivalent may prove elusive.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.

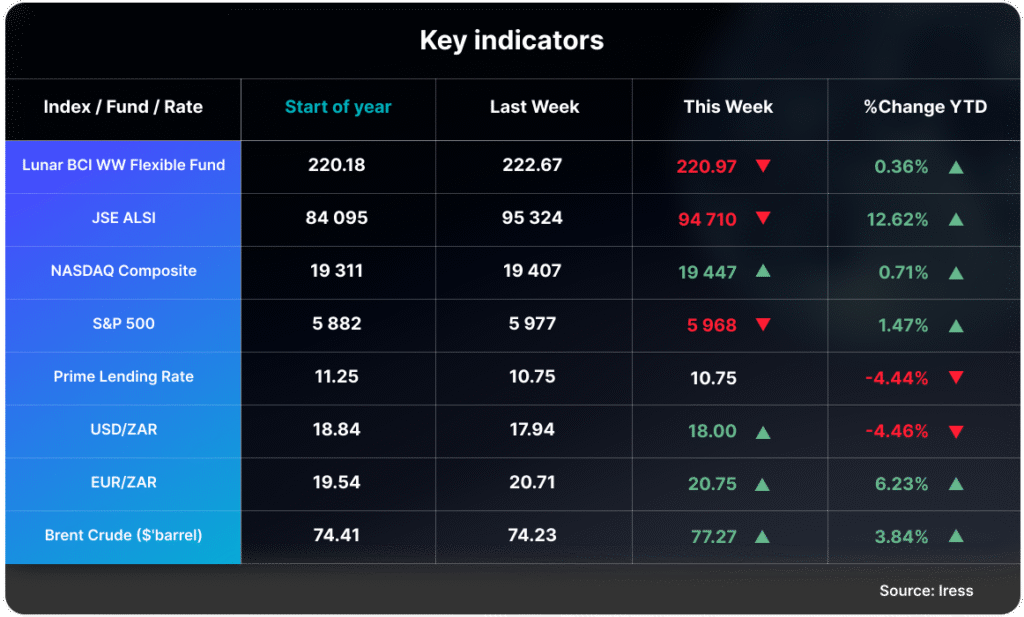

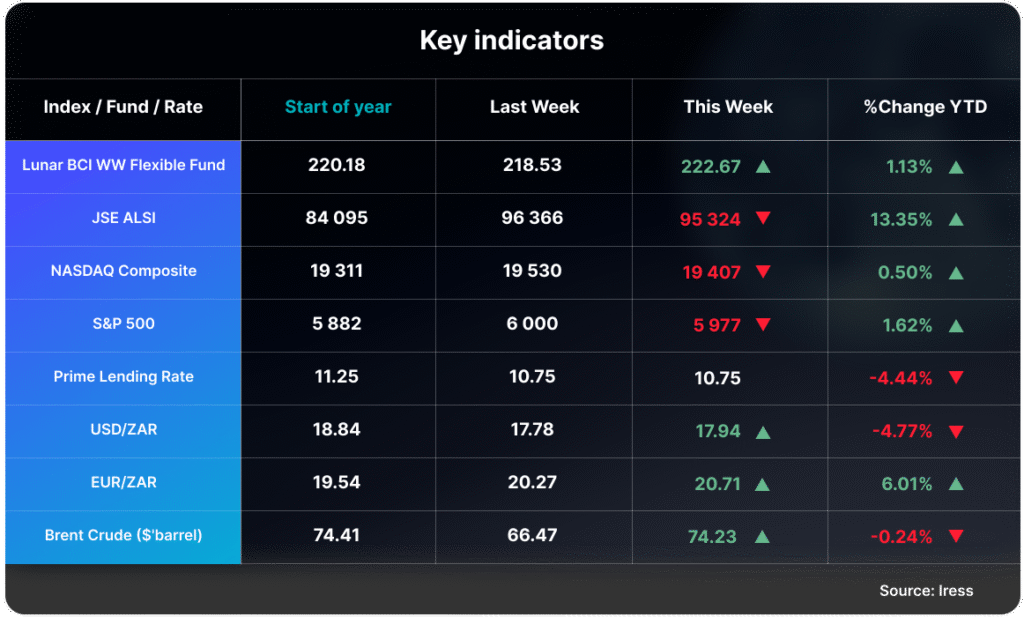

Last week, Inditex—the parent company of Zara—released its Q1 2025 results. Net sales for the quarter reached €8.2 billion, marking a modest 1.5% year-over-year increase. Net income rose to €1.3 billion, up 0.8% from the same period last year. While growth has slowed, largely due to market uncertainty surrounding tariffs, recessionary fears, and a strong euro. The company noted that in constant currency terms, sales would have increased by 4.2%.

Inditex’s hallmark is its highly flexible supply chain, which allows the company to adjust production in real time based on demand signals from both its online and physical stores.

This agility is particularly valuable during periods of economic uncertainty. With demand softening, Inditex is well-positioned to avoid excess inventory, reducing the risk of markdowns and impairments on its financial statements.

Since the COVID-19 pandemic, Inditex has been actively optimizing its store portfolio. The company has closed smaller, less productive stores while expanding larger ones and opening flagship locations in prime retail areas. This strategy has led to an increase in net sales per square metre, as customers tend to spend more when they can physically browse a broader selection of products.

Despite its focus on physical retail, Inditex continues to invest heavily in its e-commerce and logistics infrastructure. For FY24 and FY25, the company plans to allocate an additional €900 million annually in capital expenditure to enhance its logistics capabilities, supporting both online and offline growth.

Inditex maintains a strong financial position, with a net cash balance of €10.8 billion—down slightly from €11.6 billion in Q1 2024. This robust liquidity provides the company with significant strategic flexibility, enabling it to invest, expand, and navigate a market slowdown.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.

Inditex – Cut above the Rest Read More »

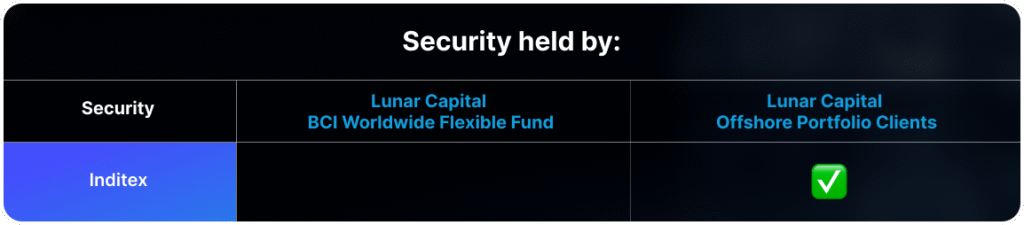

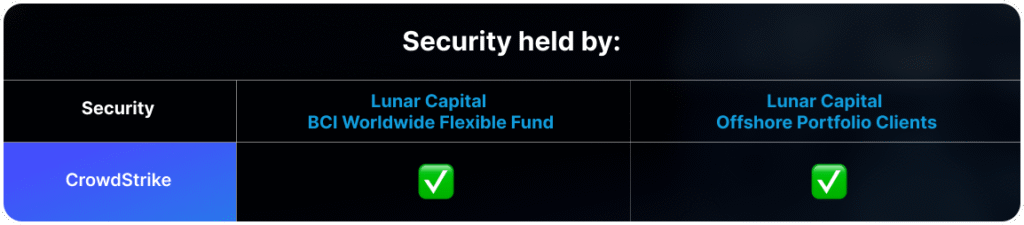

As digital transformation accelerates and AI becomes more integrated into applications—which can be exploited by nefarious actors—the importance of cybersecurity continues to grow. CrowdStrike, a cybersecurity firm specializing in cloud and AI-driven protection, released its Q1 2026 financial results last week.

The company reported quarterly revenue of $1.1 billion, representing a 19.8% year-over-year increase. Operating expenses rose to $935 million, up 35.8% from the same period last year. The disproportionate rise in operating costs was primarily driven by increased spending in research and development, as well as general and administrative expenses.

CrowdStrike has outpaced many of its peers in revenue growth, largely due to the ease with which its customizable suite of cybersecurity tools can be deployed. These services are managed through a platform that allows customers to monitor and control their security environments. Behind the scenes, CrowdStrike leverages large-scale AI models to accelerate breach detection and response.

In July 2024, the company experienced a setback when a software update caused outages on Windows-operated devices. CrowdStrike promptly resolved the issue and engaged directly with clients to reinforce confidence in its platform. In some cases, the company offered discounted rates to larger clients as a goodwill gesture. From Q1 2025 to Q1 2026, CrowdStrike’s gross profit margin declined from 75.57% to 73.8%.

While software companies typically enjoy high gross margins due to the scalable nature of their offerings, they also face substantial operating costs—particularly during growth phases to increase and improve features and to grow market share. These costs can lead to negative operating margins unless offset by strong revenue growth. Achieving scale is essential for long-term profitability in the software sector.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.

CrowdStrike – AI vs AI Read More »

Nvidia, the leading designer of graphics processing units (GPUs), reported another strong quarter of growth. For the first quarter of fiscal year 2026, the company’s revenue rose 69% year-over-year to $44.1 billion, while operating income increased 28% to $21.6 billion. The slower growth in operating income relative to revenue was primarily due to a $4.5 billion inventory write-down, resulting from U.S. government restrictions on the sale of Nvidia’s H20 chip to China.

Despite this, Nvidia’s performance remains impressive when viewed over a longer horizon. Compared to the same quarter two years ago, revenue has increased more than fivefold, and operating income has grown more than ninefold.

Currently, Nvidia dominates the market for GPUs used in training and processing data for generative AI. In 2025, big tech companies—including Microsoft, Alphabet, Meta, and Tesla—are expected to collectively spend approximately $350 billion on capital expenditures, with a significant portion directed toward building AI infrastructure.

These large tech firms have played a major role in Nvidia’s recent revenue growth. In the latest quarter, just two customers accounted for 30% of total revenue. This concentration presents a potential risk: if these companies scale back their AI investments, Nvidia’s growth could be materially affected. Acknowledging this, Nvidia has been actively working to diversify its customer base. The company is increasingly targeting national governments as customers for its AI systems. Recently, Nvidia announced deals with Saudi Arabia’s new AI initiative, Humain, and the United Arab Emirates, aimed at helping these countries develop national AI infrastructure. CEO Jensen Huang also revealed plans to travel to Europe to finalize agreements with several countries interested in building sovereign AI capabilities.

Nevertheless, big tech firms remain Nvidia’s primary revenue drivers. These companies are among the few with the scale and business models to monetize AI sustainably, which supports continued investment in AI infrastructure.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.

Nvidia – Powering Sovereign AI Ambitions Read More »

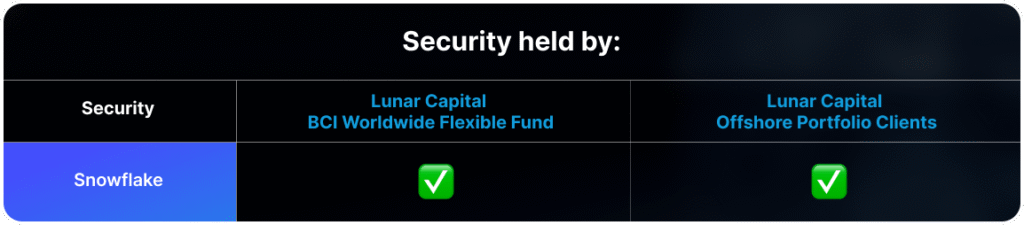

Snowflake is a company that provides a platform which enables businesses and organisations to organise and share data across multiple cloud environments. Recently, the company has been shifting its focus toward helping customers leverage their data for artificial intelligence (AI) applications.

Last week, Snowflake reported its financial results for the first quarter of fiscal year 2026. Revenue for the quarter reached $1 billion, representing a 26% increase year over year. However, the company also reported an operating loss of $447 million, up 28% from the same period last year.

Snowflake has observed a shift in its customer base since the COVID-19 pandemic. During the pandemic, its primary customers were startups that spent aggressively on cloud services. In contrast, the current customer base consists largely of larger, more cost-conscious organisations with stricter budget controls. As of the latest quarter, Snowflake serves 754 companies from the Forbes Global 2000 list and has 606 customers that each generated over $1 million in revenue over the past 12 months.

Despite strong revenue growth and a solid customer base, Snowflake faces challenges as it continues to scale. Like many smaller publicly listed companies, Snowflake uses stock-based compensation to attract and retain talent, as it may not be able to match the cash compensation offered by larger technology firms. However, this approach can lead to shareholder dilution, as it increases the total number of shares outstanding.

In Q1 2026, stock-based compensation accounted for just over 40% of Snowflake’s revenue; its operating margin was also -44%. The company managed to keep the total number of shares roughly in line with the same quarter last year by repurchasing shares from existing shareholders using its cash reserves. While this strategy helps offset dilution, it carries the risk of inefficient capital allocation, especially if shares are repurchased at high valuations.

Snowflake has demonstrated consistent revenue growth in recent years. However, its increasing reliance on stock-based compensation to support this growth may become a concern for investors if not addressed.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.

Snowflake – a Stock for Staff Read More »

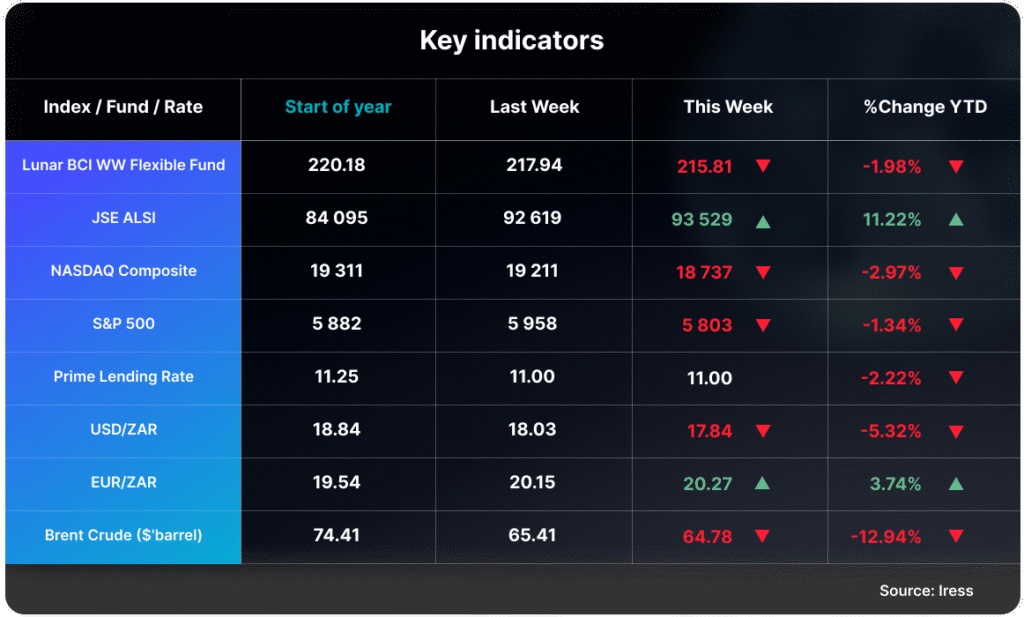

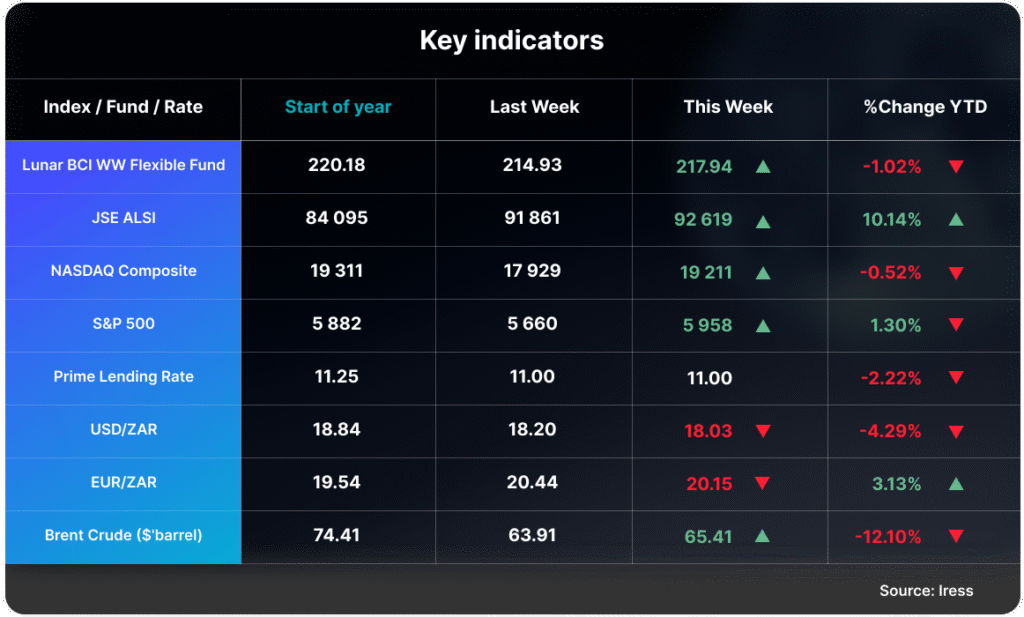

As of Friday, Walmart was trading at a trailing price-to-earnings (P/E) ratio of 42, with a market capitalization just under $800 billion.

In its Q1 2026 results, Walmart reported revenue of $165.6 billion, a 2.5% increase year over year. Operating profit rose by 4.3% to $7.1 billion, outpacing revenue growth. This improvement was driven by an increase in gross margins and higher membership income and advertising revenue, indicating effective cost management and a growing contribution from value-added services.

The company’s ecommerce segment played a significant role in its performance, growing 22% year over year. This growth was primarily fuelled by store-fulfilled pickup and delivery services. Notably, this quarter marked the first time Walmart’s ecommerce operations turned a profit.

Walmart continues to operate on thin margins. The operating margin for the quarter stood at 4.3%. The company has indicated that it may need to raise prices due to tariffs imposed by the Trump administration. Even though tariffs on Chinese goods have been reduced from 135% to 30%, prices remain elevated compared to previous levels. With approximately one-third of its goods sourced from China, Walmart has limited capacity to absorb these additional costs without materially impacting profitability.

Tariff-related uncertainty has also complicated demand forecasting. While Walmart can adjust short-term forecasts monthly, major retail events like Halloween and Black Friday require projections made up to a year in advance. This volatility makes it more challenging to plan pricing strategies and inventory levels effectively.

Large, well-managed retailers like Walmart typically perform well during economic downturns. Their scale allows them to offer lower prices than smaller competitors, capture higher income clients and market share, and maintain a relatively stable operation through financial resilience.

Walmart’s strong balance sheet, operational scale, and growing ecommerce offering, continue to provide a competitive edge in a challenging economic environment.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.

Walmart: Pricing for Perfection Read More »

Insights to your Inbox

Contact Details

Lunar Capital (Pty) Limited, registration number 2015/013022/07 is an authorised South African financial services provider (FSP 46567) established in 2015. As a licensed Financial Services Provider in terms of the FAIS Act, Lunar Capital (Pty) Limited accepts responsibility for its representatives acting within their mandates, in rendering services defined by FAIS. Our key individual and representative meet the fit and proper requirements as prescribed by FAIS.