Nvidia: Cost to Compute

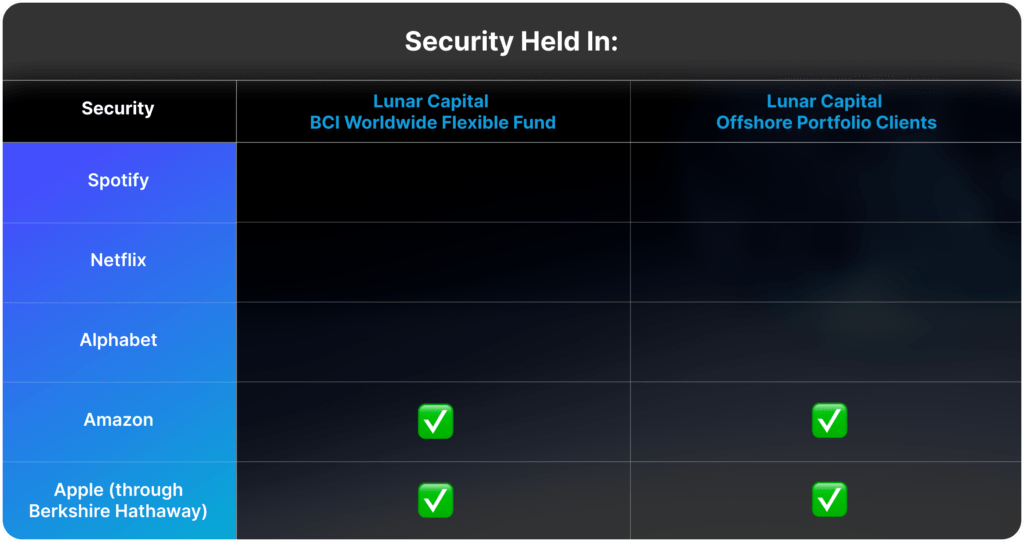

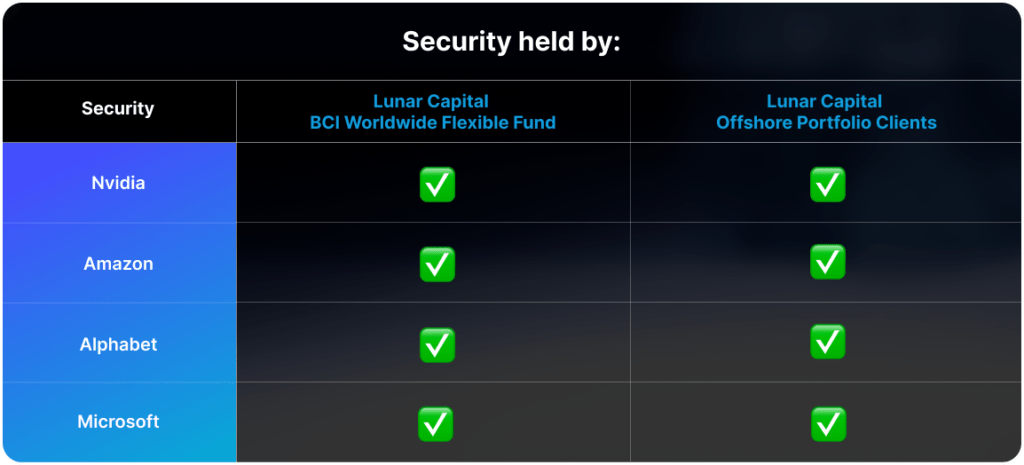

When people think of AI, they often think of OpenAI, the developer of the large language model (LLM) ChatGPT; and Nvidia, the company that designs the semiconductors used to train these LLMs. US Cloud computing giants like Amazon, Microsoft, and Alphabet are racing to enhance their LLM capabilities, and Nvidia currently offers the best chips on the market to support these efforts.

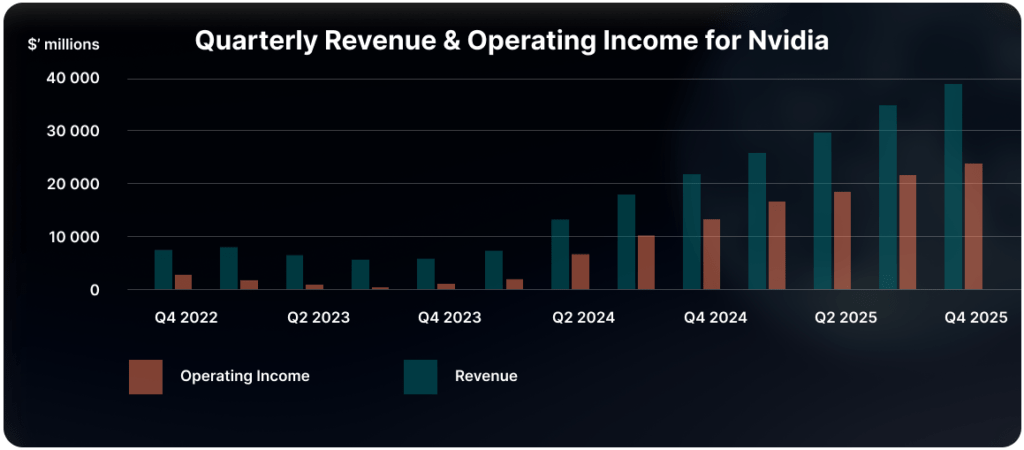

Over the last two years, the demand for Nvidia’s chips has skyrocketed. This surge in demand has driven Nvidia’s revenue from $5.9 billion in Q4 2023 to $39.3 billion in Q4 2025, a more than 5x increase. Nvidia’s operating income has also seen a dramatic rise, increasing from $1.4 billion in Q4 2023 to $24.0 billion in Q4 2025, a more than 16x increase. Nvidia’s stock price has increased nearly 450% over the past two years. The graph below illustrates Nvidia’s quarterly revenue and operating income over the last three years.

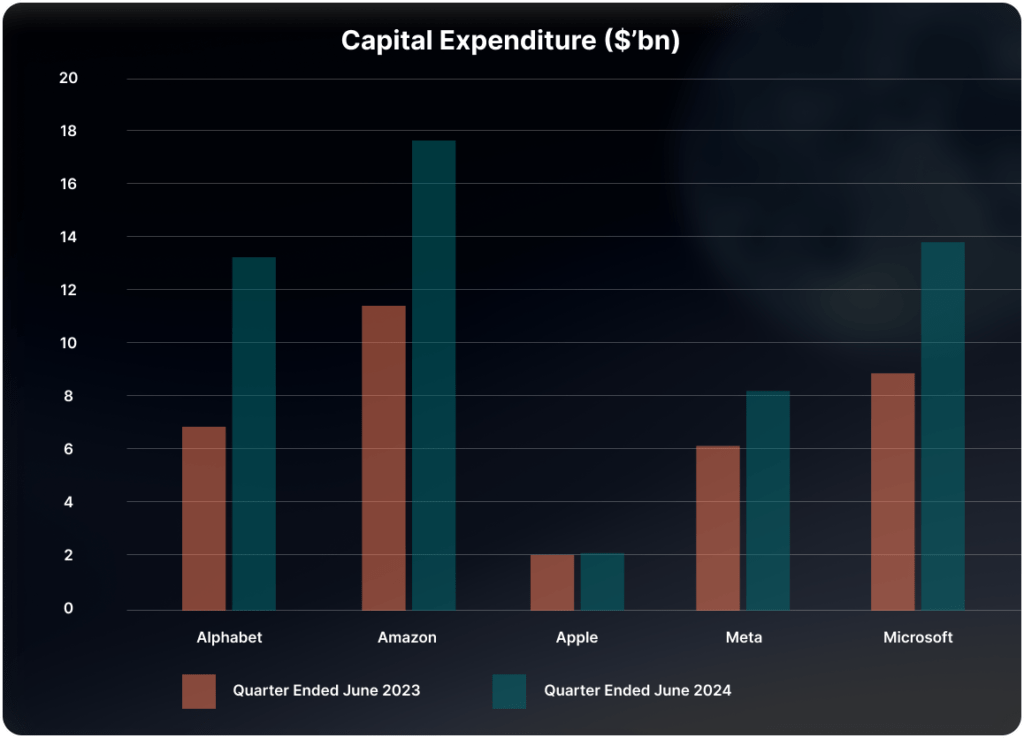

US tech companies have indicated they plan to spend $300 billion on capital expenditure to further build up their data centres for AI. While a significant portion of this spending is on Nvidia’s chips, companies like Amazon and Alphabet are also developing their own chips for more specific uses with a lower cost to compute. Whereas Nvidia’s chips are more versatile and capable of handling a variety of tasks and workloads.

Despite the long-term potential for widespread AI, investors are concerned about the substantial spending by big tech companies on these chips. Cloud service providers accounted for approximately 50% of Nvidia’s data centre revenue last year. There is a fear that these service providers may reduce their spending on the expensive Nvidia chips considering the efficiencies demonstrated by the Chinese developed DeepSeek model. Nvidia’s margins may also come under pressure as these models are effective under cheaper and older chips. These concerns were reflected in Nvidia’s share price, which dropped over 8% on Thursday despite the company reporting another record quarter last week.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.

Nvidia: Cost to Compute Read More »