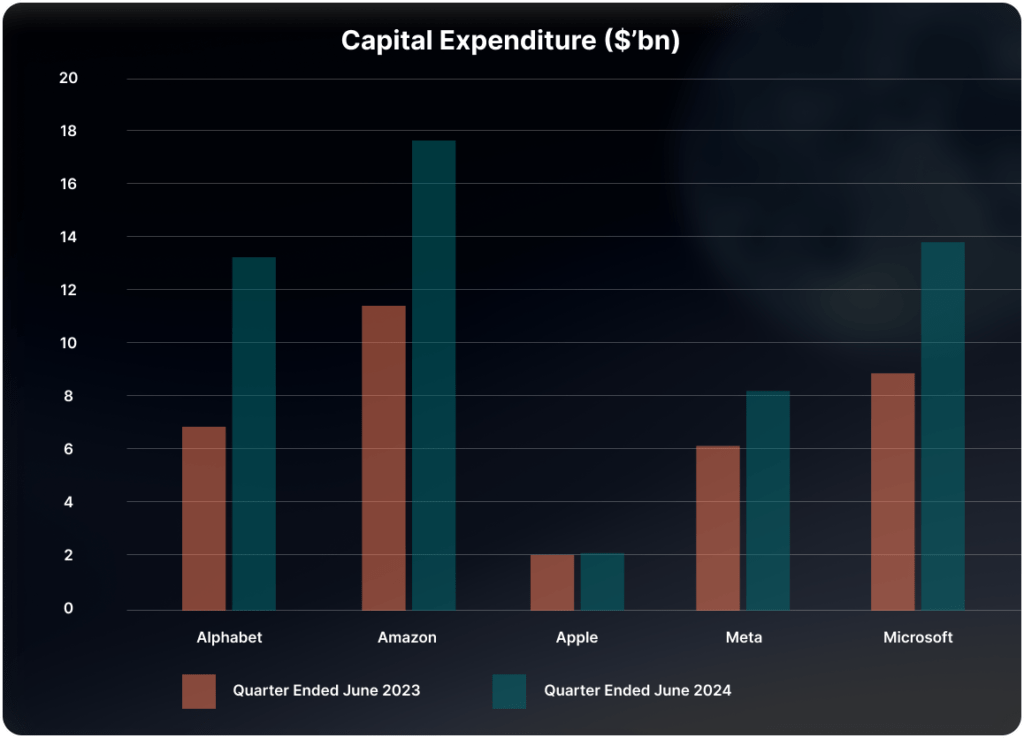

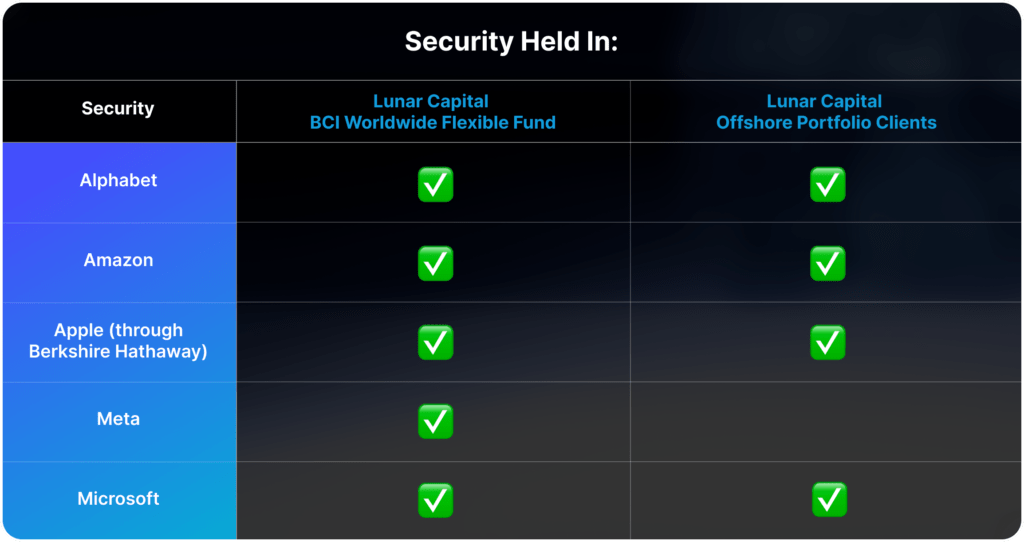

Over the last two weeks, mega-cap stocks such as Alphabet, Amazon, Apple, Meta, and Microsoft released their quarterly results. The theme was AI, particularly how much the cloud service providers were paying to build up their capacity and try to win the AI race. Investors were concerned that the cloud service providers were spending too much without clear indications of the large-scale end use cases of AI, the value derived from it, and whether businesses and people would be willing to pay for these products and services.

Due to the long time it takes to build these data centers and the logistical challenges in securing land, buildings, and chips, the big cloud providers stated that demand still exceeds supply for their AI capabilities. Additionally, they mentioned that the data centers being built offer optionality; if generative AI doesn’t take off, the data centers can be repurposed for other uses; although it will be at a lower operating margin.

The graph below shows the difference in capital expenditure by the big tech firms this year. Everyone but Apple has significantly increased their spending to build up their capacity for generative AI workloads—whether for training or inferencing. During the earnings calls, all the big tech CEOs indicated they would continue to spend at these increased levels to ensure they don’t miss out on the generative AI opportunity.

At the moment, the company seeing a real and significant increase in revenue and earnings is Nvidia, the designer of the high-powered chips used to train and inference the data workloads for generative AI. Nvidia is expected to release their results on the 28th of August. The search is on for the companies that will utilize AI within their own operations to give themselves the edge and gain market share in their own industry and possibly beyond.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.