Walmart: Pricing for Perfection

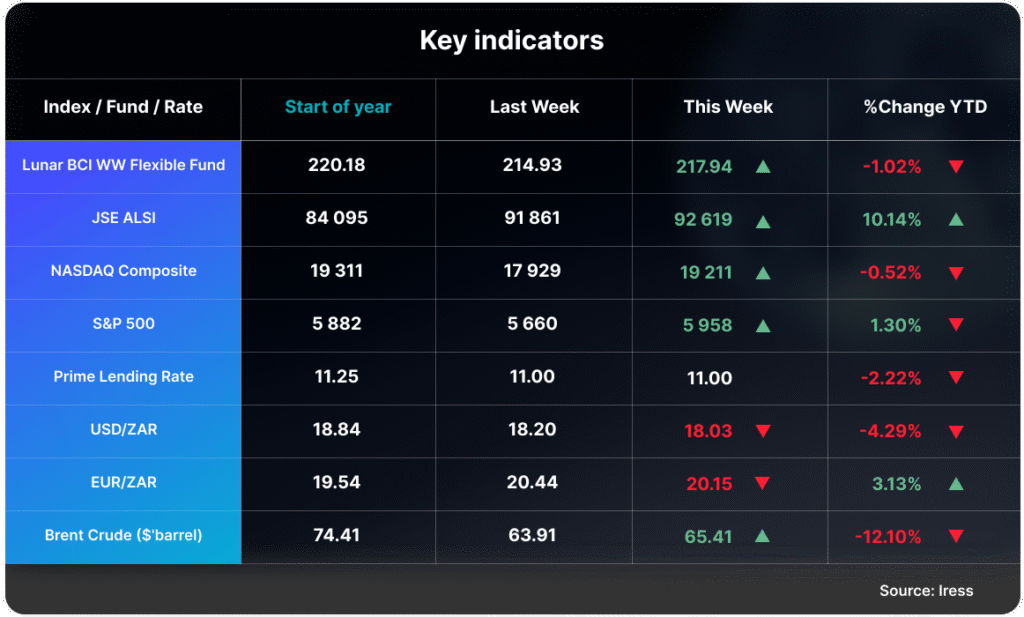

As of Friday, Walmart was trading at a trailing price-to-earnings (P/E) ratio of 42, with a market capitalization just under $800 billion.

In its Q1 2026 results, Walmart reported revenue of $165.6 billion, a 2.5% increase year over year. Operating profit rose by 4.3% to $7.1 billion, outpacing revenue growth. This improvement was driven by an increase in gross margins and higher membership income and advertising revenue, indicating effective cost management and a growing contribution from value-added services.

The company’s ecommerce segment played a significant role in its performance, growing 22% year over year. This growth was primarily fuelled by store-fulfilled pickup and delivery services. Notably, this quarter marked the first time Walmart’s ecommerce operations turned a profit.

Walmart continues to operate on thin margins. The operating margin for the quarter stood at 4.3%. The company has indicated that it may need to raise prices due to tariffs imposed by the Trump administration. Even though tariffs on Chinese goods have been reduced from 135% to 30%, prices remain elevated compared to previous levels. With approximately one-third of its goods sourced from China, Walmart has limited capacity to absorb these additional costs without materially impacting profitability.

Tariff-related uncertainty has also complicated demand forecasting. While Walmart can adjust short-term forecasts monthly, major retail events like Halloween and Black Friday require projections made up to a year in advance. This volatility makes it more challenging to plan pricing strategies and inventory levels effectively.

Large, well-managed retailers like Walmart typically perform well during economic downturns. Their scale allows them to offer lower prices than smaller competitors, capture higher income clients and market share, and maintain a relatively stable operation through financial resilience.

Walmart’s strong balance sheet, operational scale, and growing ecommerce offering, continue to provide a competitive edge in a challenging economic environment.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.

Walmart: Pricing for Perfection Read More »