ShopRite on Track

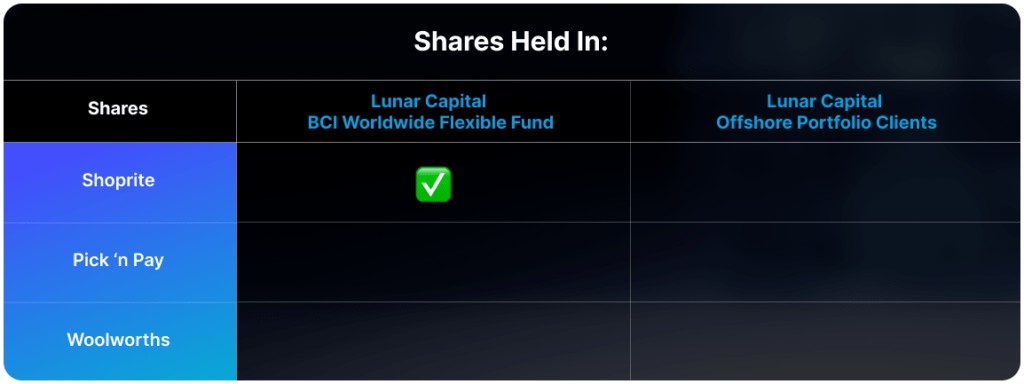

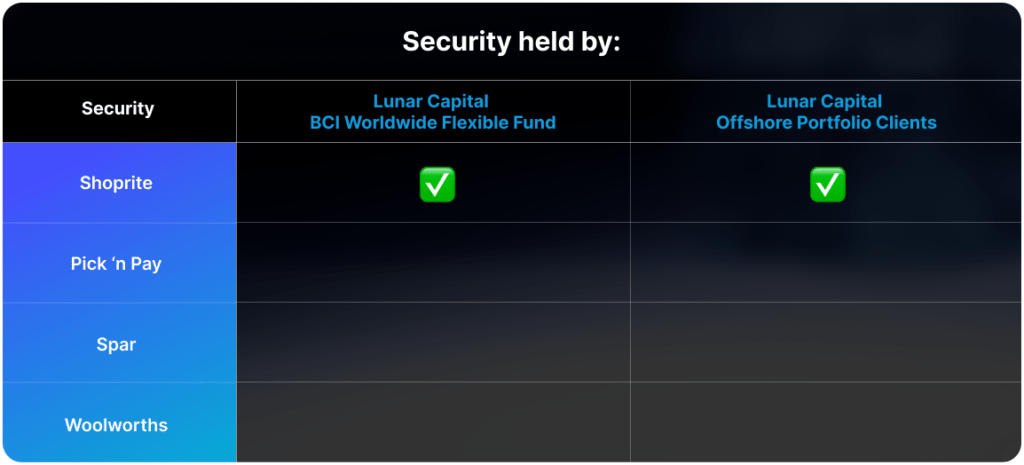

Shoprite, South Africa’s largest consumer goods retailer by revenue, has continued to expand its market share, outperforming competitors such as Pick ‘n Pay, Woolworths, Spar, and others. For the 26-week period ending December 29, 2024, Shoprite Group increased its merchandise sales by 9.6% to R128.6 billion, higher than its competitor’s growth rate of 3.1%. The gross margin for Shoprite improved by 30 basis points to 23.9%, while profit for the period rose by 11.9% to R3.7 billion, representing a 2.8% profit margin.

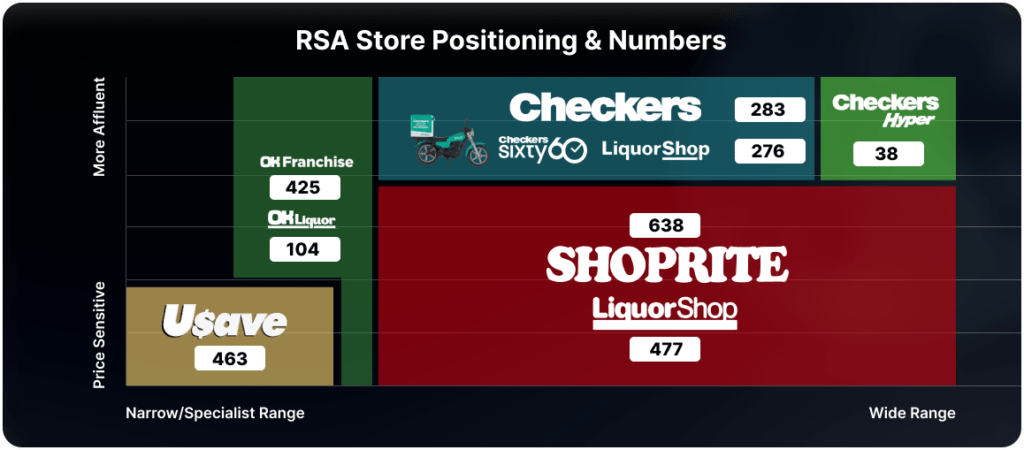

Shoprite’s growth strategy revolves around its three core businesses: Checkers, Shoprite, and OK. It also has businesses in 10 countries outside of South Africa. These brands target different market segments based on customer price sensitivity and product range. Shoprite leverages its core businesses to venture into new products and services, ensuring that each new initiative is anchored to one of its established brands. For instance, the delivery service Sixty60, is an add-on service to the Checkers brand, and has recently also been added as a service to the Shoprite brand.

Given the low margins that Shoprite commands, the company exercises caution when entering new markets. Their approach involves opening stores in select locations and expanding based on the traction those ventures get. The success of the Checkers Sixty60 service has prompted plans to extend the delivery service to Shoprite-branded stores. Additionally, the Group has diversified into pet stores, baby stores, clothing stores, and other retail ventures.

Shoprite faces the risk of over-investing in its quest for market share and growth. In a stagnant economy, this could lead to riskier ventures. One such venture that has not met expectations is their furniture business. Recently, Shoprite decided to sell its OK Furniture and House & Home business, which had a merchandise sales growth rate of 6.2%, below Shoprite’s overall growth rate of 9.6%. The trading margin for the furniture business also decreased by 30 basis points to 4.8%.

Shoprite is known for its diligence. The company’s price-to-earnings ratio trades at a premium of 30%-40% compared to Woolworths and Spar. Any operational missteps could result in significant adjustments to its stock price.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.