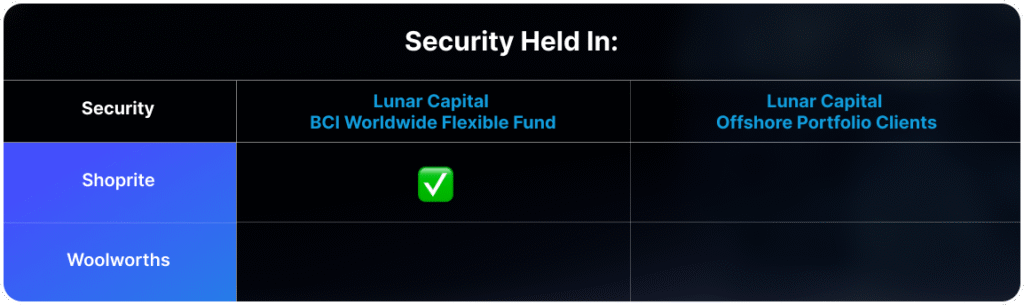

Last week, two South African grocery retailers, Shoprite and Woolworths, released their financial results for FY 2025, revealing contrasting performances.

Shoprite reported revenue of R256 billion, up 8.6% year-over-year. Gross profit rose 10.6% to R61.4 billion, while operating income increased 16.6% to R15 billion. These results were buoyed by the exceptional growth of its Sixty60 delivery service, which generated R18.9 billion in revenue — up 48% year-over-year. Sixty60 now accounts for 8.9% of total group sales and 19% of Checkers sales. CEO Pieter Engelbrecht noted that Sixty60 customers are nearly four times more valuable than in-store-only customers, with higher average order values.

Shoprite also demonstrated strong cost management. Internal inflation was kept below 2%, and operating expenses rose 7.4%, a slower pace than revenue growth. Notably, diesel costs fell 56% to R355 million, and repairs and maintenance expenses declined 7.8%, contributing to margin expansion.

Woolworths, by contrast, posted more subdued results. Revenue grew 3.8% to R80.2 billion, but gross profit declined 0.7% to R27.3 billion, and operating income fell 15.6% to R5.1 billion. While the Food division performed well, generating R51.2 billion, up 8.7%, the Fashion, Beauty, and Home (FBH) and Country Road Group (CRG) divisions weighed down overall performance. FBH grew 2.4% to R15.1 billion, while CRG declined 10.5% to R12.4 billion. These segments typically carry higher operating margins, so their underperformance had a disproportionate impact on profitability.

Shoprite and Woolworths’ results highlight the diverging fortunes of two major retailers; one benefiting from scale and innovation, the other weighed down by underperforming segments. But for both, the path forward remains challenging. South Africa’s weak macroeconomic backdrop, marked by low growth and constrained consumers, continues to limit the upside for even the best-run businesses.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.