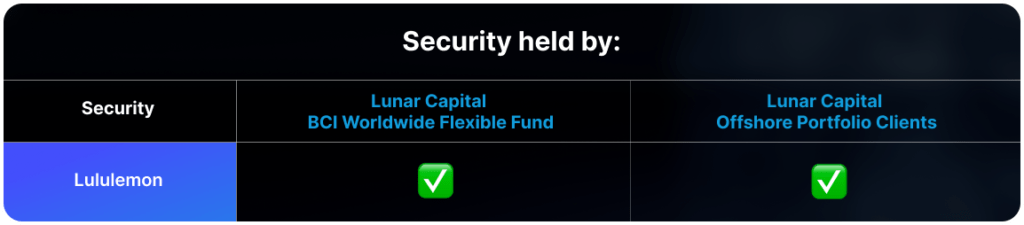

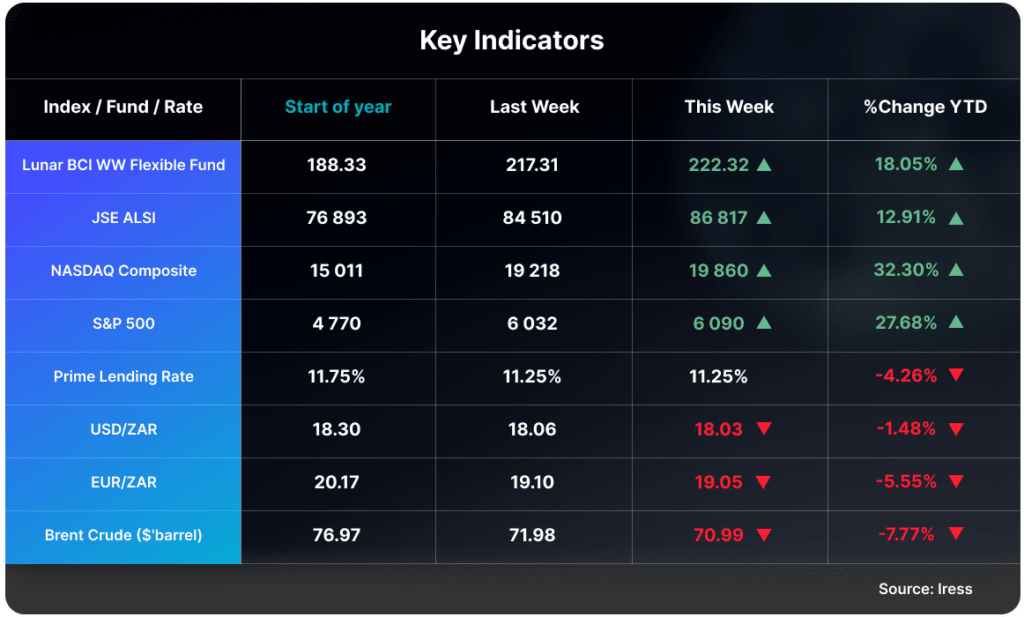

The premium athleisure brand Lululemon has gone through a rough patch this year. Last week the company released their third quarter 2024 results, sending the stock just under 16% higher on the day. However, year to date, the stock is down 14%, compared to the S&P 500 index, which is up just under 28%.

The two main issues Lululemon recently faced are:

- Earlier this year, Lululemon released a selection of leggings that did not meet customer preferences. The range lacked sufficient colour options and had incorrect size quantities, resulting in missed sales in key locations such as the US.

- Another challenge that Lululemon encounters is the highly competitive market in which they operate. If customers are dissatisfied with the products, they can easily switch to other brands. Given the premium pricing of Lululemon items, customers tend to be particularly discerning and may readily choose alternatives.

During the earnings call, Lululemon stated that they will focus more on their existing customers in the US, rather than significantly expanding the total number of stores to gain new customers. Of the total revenue of $2.4 billion in Q3 2024, America accounted for 79% of the revenue. One of the strategies Lululemon is implementing is increasing the percentage of new products to total products in their stores as a way of encouraging current customers to spend more at their stores. The next few quarters will indicate the success of this strategy.

Despite some challenges in the US market, Lululemon’s international segment has shown significant growth. The segment in China grew by 39% to $318 million, while revenue from regions outside the Americas and China increased by 27% to $308 million.

Internally, the company maintains healthy margins. The gross margin for Q3 2024 was 58.5%, an improvement from 57% in the same quarter of the previous year. Furthermore, Lululemon’s operating margin for this quarter was 20.5%, compared to 15.3% in the same period last year.

Lululemon primarily sells through its stores, giving it greater control over its brand. This strategy allows for quicker adjustments. However, challenges remain, and only time will tell if they regain customer favour.

This is the last Stocktake of the year. Have a great festive season and travel safely. The Weekly Stocktake with Danyaal will resume in January.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.