Nvidia, the leading designer of graphics processing units (GPUs), reported another strong quarter of growth. For the first quarter of fiscal year 2026, the company’s revenue rose 69% year-over-year to $44.1 billion, while operating income increased 28% to $21.6 billion. The slower growth in operating income relative to revenue was primarily due to a $4.5 billion inventory write-down, resulting from U.S. government restrictions on the sale of Nvidia’s H20 chip to China.

Despite this, Nvidia’s performance remains impressive when viewed over a longer horizon. Compared to the same quarter two years ago, revenue has increased more than fivefold, and operating income has grown more than ninefold.

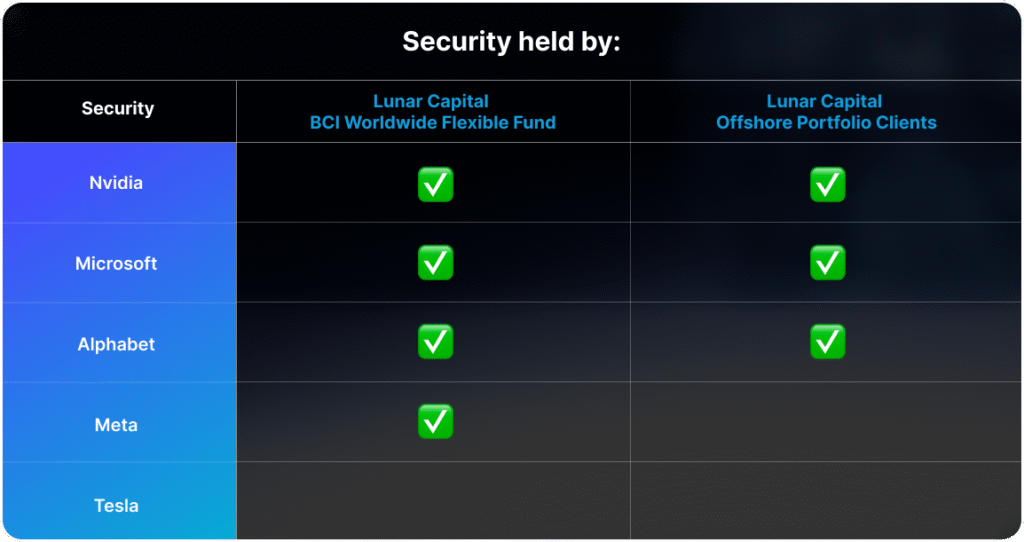

Currently, Nvidia dominates the market for GPUs used in training and processing data for generative AI. In 2025, big tech companies—including Microsoft, Alphabet, Meta, and Tesla—are expected to collectively spend approximately $350 billion on capital expenditures, with a significant portion directed toward building AI infrastructure.

These large tech firms have played a major role in Nvidia’s recent revenue growth. In the latest quarter, just two customers accounted for 30% of total revenue. This concentration presents a potential risk: if these companies scale back their AI investments, Nvidia’s growth could be materially affected. Acknowledging this, Nvidia has been actively working to diversify its customer base. The company is increasingly targeting national governments as customers for its AI systems. Recently, Nvidia announced deals with Saudi Arabia’s new AI initiative, Humain, and the United Arab Emirates, aimed at helping these countries develop national AI infrastructure. CEO Jensen Huang also revealed plans to travel to Europe to finalize agreements with several countries interested in building sovereign AI capabilities.

Nevertheless, big tech firms remain Nvidia’s primary revenue drivers. These companies are among the few with the scale and business models to monetize AI sustainably, which supports continued investment in AI infrastructure.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.