Lunar Capital

on Eastwave Radio

Every Wednesday, at 07h45, Sabir chats with Nazia from Eastwave Radio (92.2 fm, live stream on

www.eastwave.co.za) on investing and the markets.

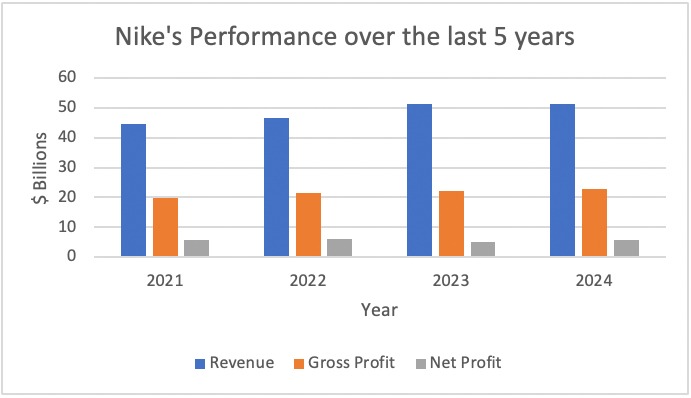

Last week Nike released their Q4 and FY2024 results. Revenue for the year was $51.4 billion, flat compared to 2023. Net Income for the year was $5.7 billion, up 12% compared to the same period last year. Below is a graph showing key metrics for Nike over the last four years. Since 2021, Nike’s revenue has increased just over 13 percent. While its net income has remained flat.

Before the Covid-19 pandemic, Nike had already started investing in its Nike Direct business, which includes company-operated stores and its e-commerce division. This focus on e-commerce proved beneficial both before and during the pandemic when consumers were unable to leave their homes. Nike Direct accounted for just under 44% of Nike Brand revenue in 2024, compared to 32% in 2019. The wholesale business, which sells to third-party stores on consignment, accounted for 56% of Nike Brand revenue in 2024.

Over the last few years, running has surged in popularity, likely due to pent-up demand from the Covid-19 pandemic. The London Marathon received a record 840,000 applications for the ballot for the 2025 race, surpassing the previous record of 578,000 in 2024. Despite its roots in running, Nike has struggled to capitalize on this trend, losing market share to competitors like On Holding, Hoka (owned by Deckers), and Brooks.

Fashion is fickle. Brands that are successful today may not be next year, and vice versa. Nike faces the challenge of growing revenue from an already high base. For example, Hoka’s 2024 revenue was $1.11 billion, roughly 2% of Nike’s 2024 revenue. Nike has better financial strength compared to many of its competitors to withstand setbacks. It could possibly even use this to pivot its company to get back in favour with consumers.

Nike’s share price is down from a peak of $179.10 (November 2021) to $74.85 per share at the time of writing.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.

Lunar Capital

on Eastwave Radio

Every Wednesday, at 07h45, Sabir chats with Nazia from Eastwave Radio (92.2 fm, live stream on

www.eastwave.co.za) on investing and the markets.