Three years ago, Netflix’s stock price experienced a significant decline of more than 70% from its peak reached at the end of 2021. This decrease was driven by the loss of subscribers for the first time in Netflix’s history. Analysts also argued that Netflix was unable to maintain its market leadership and effectively counter the competition. Concurrently, inflation in the United States was rising to levels not seen for decades.

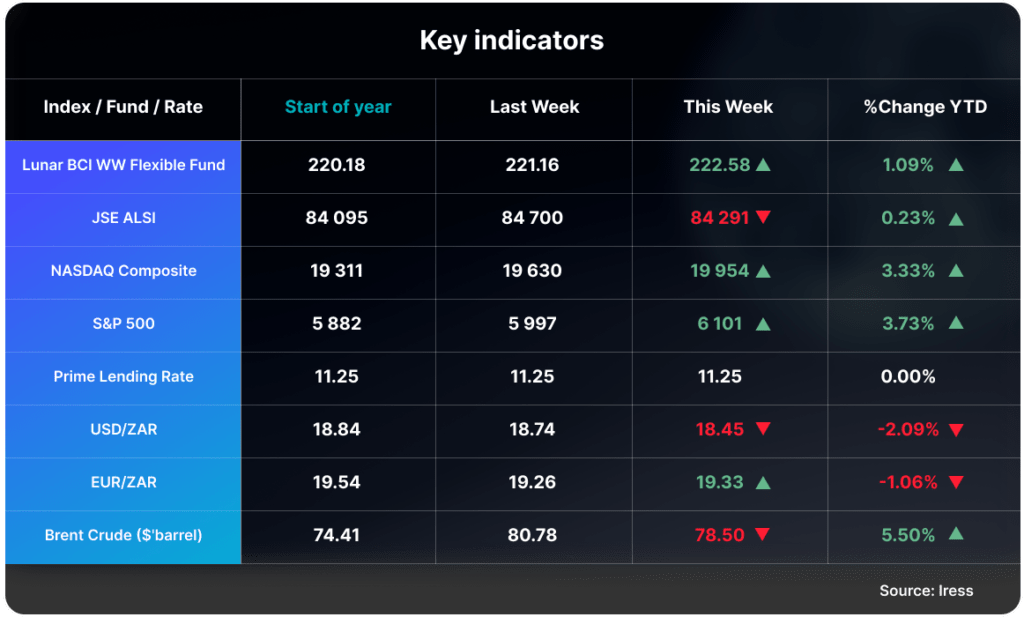

However, last week, Netflix achieved new stock price highs, with the stock closing at $977 on Friday. Netflix ended the week with price-to-earnings ratio of just over 49 and a market capitalization of $417 billion.

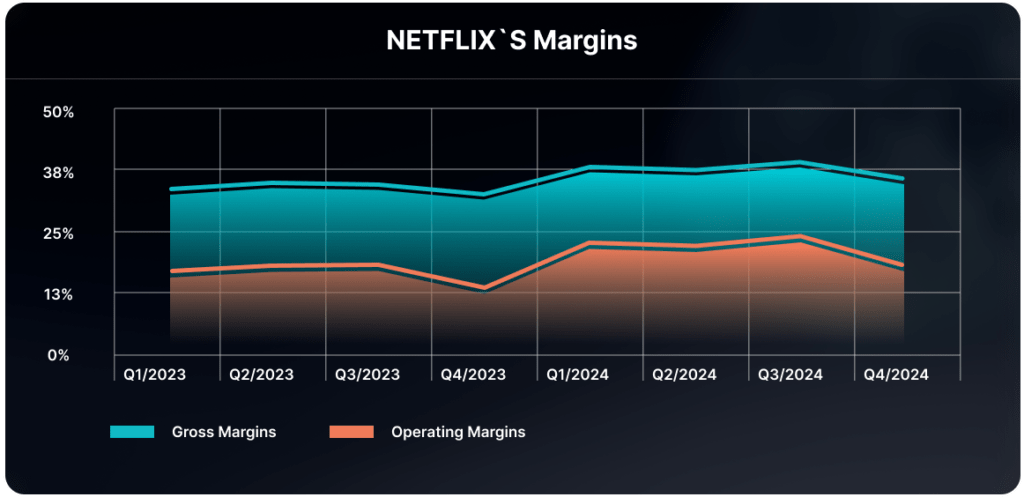

Netflix saw an increase in their number of subscribers by nearly 20 million in Q4 2024, reaching just over 300 million subscribers worldwide. Revenue for Netflix rose by 16% to $10.24 billion, while operating profit grew by 52% to $2.3 billion. The significant rise in profitability was attributed to operational leverage. Netflix managed to expand its subscriber base without a proportional increase in operating costs. The below graph shows the change in profitability for Netflix over the last two years.

Why is there so much positivity behind Netflix’s business?

Netflix is uniquely positioned to concentrate their efforts exclusively on streaming, unlike competitors in the entertainment sector who balance their newer streaming initiatives with their currently-profitable legacy assets.

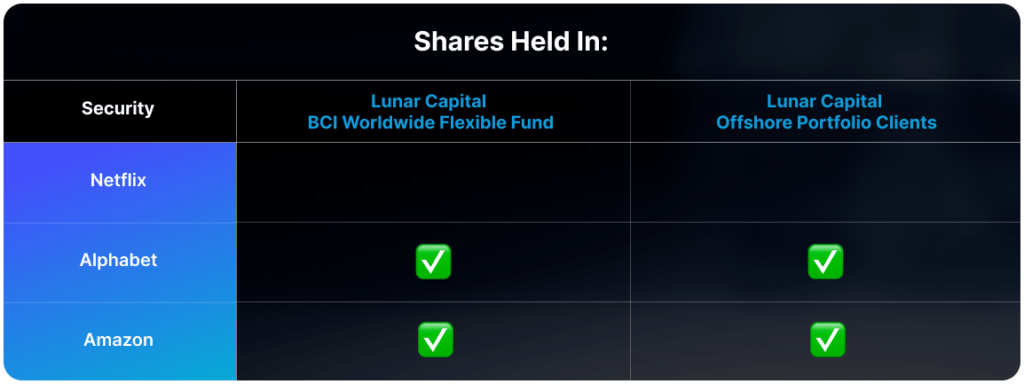

Other competitors, such as YouTube (a subsidiary of Alphabet) and Amazon Prime, have primary businesses in areas such as search and e-commerce that demand extensive company resources in terms of effort and capital. Consequently, these companies may not place a high enough priority on their streaming business, potentially resulting in a loss of market share.

Netflix also has an extensive lineup of new shows and movies scheduled for release this year, as part of its strategy to further expand its revenue base. The company has also introduced advertising packages in numerous markets and plans to scale these efforts throughout the year. Following the success of live events such as the Jake Paul vs. Mike Tyson fight, Netflix is exploring opportunities to develop its live events segment, focusing on occasional events rather than expensive, year-long sports leagues.

However, despite their recent successes, Netflix faces significant competition, increasing costs, and shifting consumer preferences. A few missteps could considerably impact the company’s performance.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.