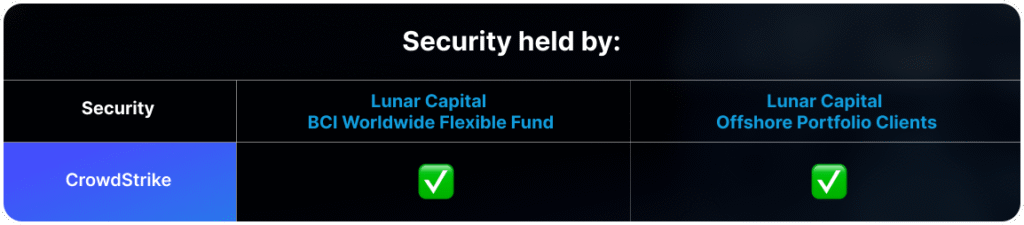

As digital transformation accelerates and AI becomes more integrated into applications—which can be exploited by nefarious actors—the importance of cybersecurity continues to grow. CrowdStrike, a cybersecurity firm specializing in cloud and AI-driven protection, released its Q1 2026 financial results last week.

The company reported quarterly revenue of $1.1 billion, representing a 19.8% year-over-year increase. Operating expenses rose to $935 million, up 35.8% from the same period last year. The disproportionate rise in operating costs was primarily driven by increased spending in research and development, as well as general and administrative expenses.

CrowdStrike has outpaced many of its peers in revenue growth, largely due to the ease with which its customizable suite of cybersecurity tools can be deployed. These services are managed through a platform that allows customers to monitor and control their security environments. Behind the scenes, CrowdStrike leverages large-scale AI models to accelerate breach detection and response.

In July 2024, the company experienced a setback when a software update caused outages on Windows-operated devices. CrowdStrike promptly resolved the issue and engaged directly with clients to reinforce confidence in its platform. In some cases, the company offered discounted rates to larger clients as a goodwill gesture. From Q1 2025 to Q1 2026, CrowdStrike’s gross profit margin declined from 75.57% to 73.8%.

While software companies typically enjoy high gross margins due to the scalable nature of their offerings, they also face substantial operating costs—particularly during growth phases to increase and improve features and to grow market share. These costs can lead to negative operating margins unless offset by strong revenue growth. Achieving scale is essential for long-term profitability in the software sector.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.