Shoprite, South Africa’s largest retailer, released its 2024 full-year results last week. The company reported total revenue of R240.7 billion, reflecting a 12% increase year-over-year. Their trading profit also saw an increase of 12.4%, reaching R13.4 billion, which translates into a trading margin of 5.5% for the year. Shoprite’s gross profit rose by 11.7% to R57.8 billion, resulting in a gross margin of 24.0% for the year.

Shoprite has been expanding. They have been continuously striving to capture a larger and larger share of the retail market. Since 2021, the group has increased its number of stores by 25.7%, reaching a total of 3,639 outlets. Their Xtra savings loyalty card membership has also surged by 10.7 million members since 2021 to 31 million members at the end of their 2024 financial year. This has greatly aided their data-driven AI strategy to better understand and serve their customers. The expansion and insights have resulted in their sales growing by 43% compared to the 2021 levels.

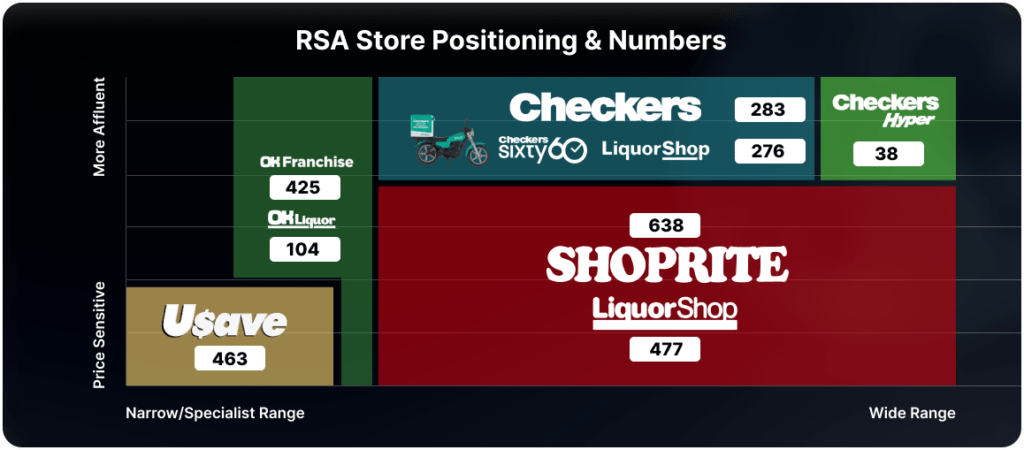

The brands under Shoprite’s umbrella include Shoprite, Usave, Checkers, Uniq, Medirite, and others. Shoprite caters to both affluent and low-income customers and is present in rural and urban areas alike. The graph below illustrates how Shoprite perceives its brands and their positioning in South Africa. Notably, last year, Checkers, Shoprite’s premium brand which yields slightly higher margins, was the fastest growing brand in the premium supermarket space. The growth was fuelled by the success of their delivery service Checkers Sixty60.

Source: https://www.shopriteholdings.co.za/docs/results-presentation-2024.pdf

Shoprite employs a hub-and-spoke model. When establishing a supermarket like Shoprite or Checkers in a new area, they subsequently set up other branded stores nearby, such as their pharmacy chain Medirite or clothing store Uniq, creating a complementary shopping ecosystem that attracts customers to these auxiliary outlets.

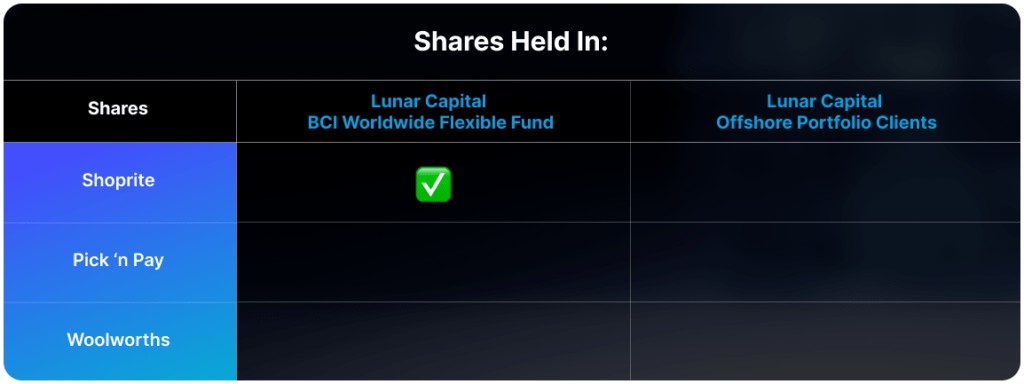

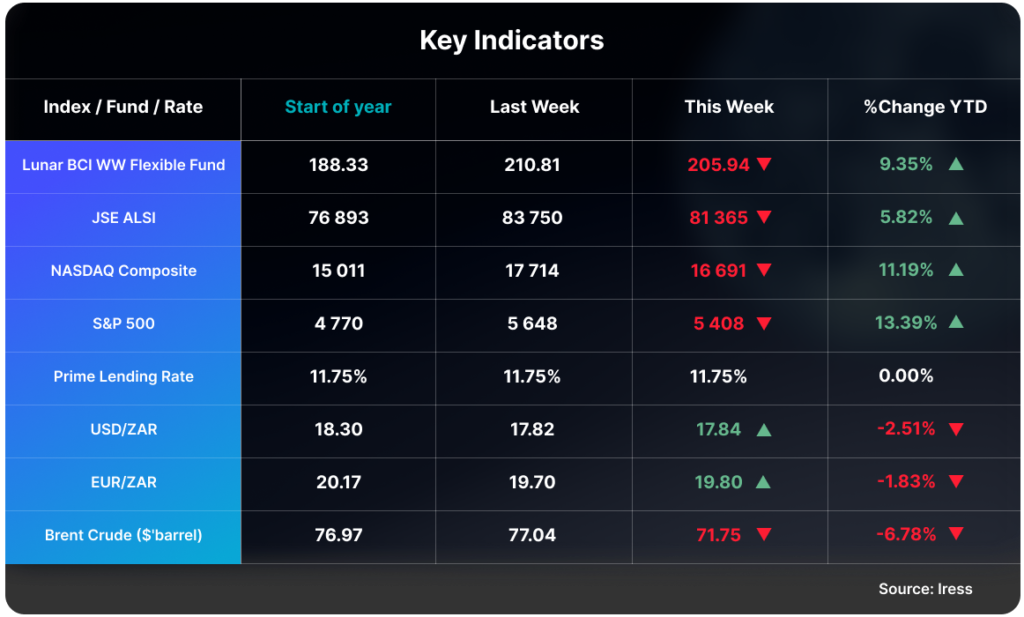

Last week, Shoprite’s share price fell by just over 3%, amid market expectations for slightly stronger results. Shoprite trades at a price-to-earnings (PE) ratio of around 24, which is higher than Pick ‘n Pay’s PE ratio of -11 (due to major write-offs) and Woolworths’ (Woollies) PE ratio of 18. This indicates the premium investors are willing to pay to hold Shoprite shares.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.