Lunar Capital

on Eastwave Radio

Every Wednesday, at 07h45, Sabir chats with Nazia from Eastwave Radio (92.2 fm, live stream on

www.eastwave.co.za) on investing and the markets.

Lululemon, the athleisure brand, and Inditex (owner of fashion brands such as ZARA, Oysho, and others) primarily share one similarity: they both make clothes. However, these brands are quite different in terms of their target audience, operational methods, and growth stages.

Lululemon, founded in Vancouver, initially made yoga clothing before expanding into other types of athleisure for various sports. Lululemon has just over 700 stores around the world. Lululemon targets the upper-income segment, focusing on creating high-quality products primarily for women. This approach contrasts with other major athleisure brands like Nike and Adidas. Lululemon also sponsors local trainers and influencers, believing they have a closer connection with their community compared to big stars. Lululemon generally sets trends for each season, attempting to design and produce enough to meet the needs of its client base.

Inditex, on the other hand, operates quite differently. Catering to middle and upper-middle income groups, they have just under 7,300 stores worldwide. Inditex’s biggest brand, ZARA, focuses on offering customers the latest trends. ZARA uses a Just-in-Time vertical integration method. Their scouts attend fashion shows to identify trends, which are then sent to designers. These designs are quickly produced in factories and appear on shelves within 2-3 weeks. Depending on demand, ZARA can easily ramp up or scale down production, producing closer to what is actually needed. This results in there being just enough items in their stores to meet demand.

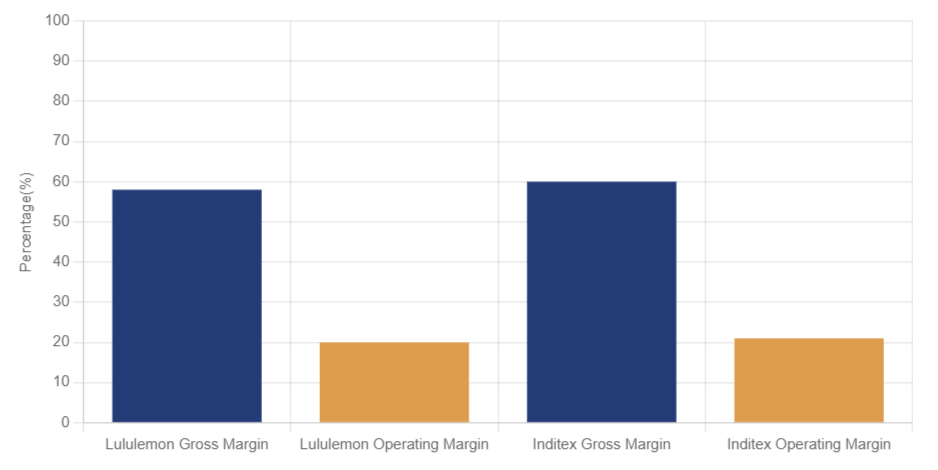

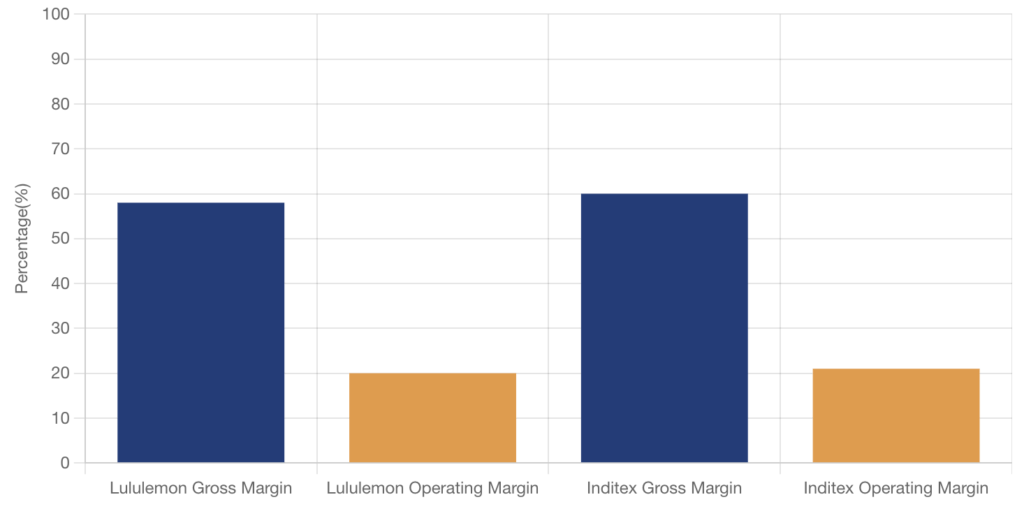

Despite Inditex being just under 4 times bigger than Lululemon in terms of market cap, the graph below shows how similar their gross and operating margins are. The also both have a PE ratio of around 25.

Last week, Lululemon and Inditex released their respective Q1 2024 results. Lululemon’s revenue for the quarter was $2.2 billion, up 10% year-on-year, while operating income was $432.6 million, up 7.7% year-on-year. Lululemon attributed the weakness in their sales growth to a limited colour range in certain women’s products in the US, missing an opportunity to meet demand. Combined with slowing overall demand in the US and Europe, heightened competition in the athleisure space, and the missed opportunity, Lululemon’s stock price has decreased by over 35% year-to-date.

Inditex, on the other hand, had a revenue of €8.2 billion for the quarter, up 7.1% year-on-year. While their operating income was €1.6 billion for the quarter, up 10.3% year-on-year. Inditex expressed that they are planning to spend €1.8 billion, over the next two years, on their supply chain as they look to bolster up their e-commerce offering, while also maintaining their physical presence with their stores.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.

Lunar Capital

on Eastwave Radio

Every Wednesday, at 07h45, Sabir chats with Nazia from Eastwave Radio (92.2 fm, live stream on

www.eastwave.co.za) on investing and the markets.