For decades, the saying went: don’t bet against the House of Mouse. Whenever Disney appeared to face an existential crisis, it always emerged stronger. But over the past decade, that resilience has faltered. The company’s stock price is down just over 12% during this period—a stark contrast to its historic reputation for growth.

Founded in 1923, Disney built its empire on beloved films and franchises. From in-house classics like The Lion King to acquisitions such as Pixar, Marvel, Lucasfilm, and Fox; the company has amassed one of the most powerful intellectual property portfolios in entertainment. Beyond film and television, Disney also operates a significant theme park and cruise business, reinforcing its global reach.

Acquisitions have been central to Disney’s success. The company spent just under $15.5 billion acquiring Pixar, Lucasfilm, and Marvel. Marvel alone has generated over $30 billion at the global box office – excluding additional revenue from merchandise, theme park attractions, and licensing. These wins emboldened Disney to pursue its largest deal yet: the $71.3 billion acquisition of 21st Century Fox in 2019, which brought film and TV studios, FX Networks, National Geographic, and a majority stake in Hulu under its umbrella.

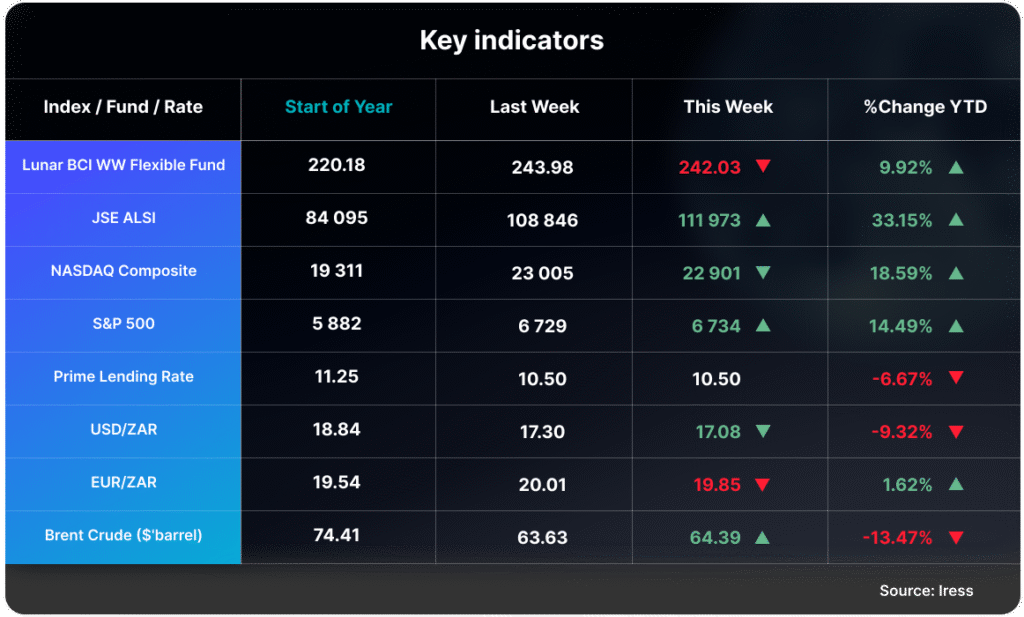

Since September 2018, Disney’s revenue has grown 59%, an annualized rate of 6.8%. Profitability tells a similar story. Return on equity has fallen from 26.7% in 2018 to 12.1% in the most recent fiscal year.

The company now faces a strategic dilemma: balancing its legacy businesses like linear TV with the demands of streaming. Disney+ and its streaming portfolio have grown revenue by 8% to $6.2 billion, while operating income surged 39% to $352 million. Yet, margins remain thin at 5.6%, underscoring the challenge of turning streaming into a sustainable profit engine.

Despite its unrivalled IP and global brand recognition, Disney appears to have saturated its audience base. The question is can the company translate their IP into profitable growth in an era of shifting consumer habits and fierce competition?

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.