The semiconductor industry is composed of several key players, each playing a distinct role in the supply chain. Among the most important are the designers, manufacturers, and equipment suppliers.

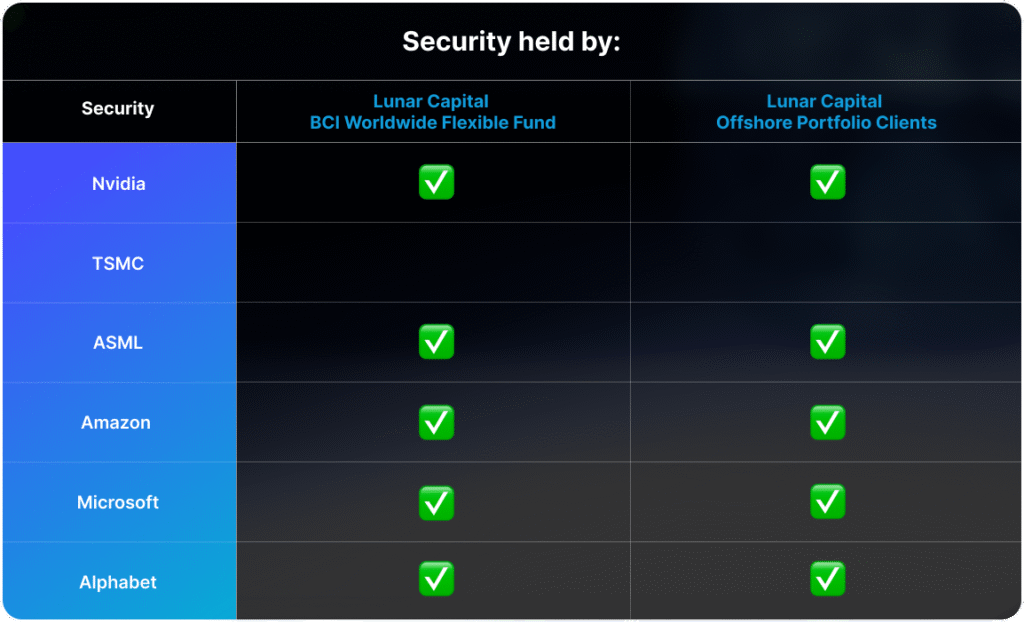

Designers such as Nvidia are responsible for creating the architecture of various semiconductor chips. These chips are then sold directly to clients like Amazon, Microsoft, and Alphabet, where they serve as the backbone of cloud computing infrastructure and AI workloads.

Once designed, the chips are sent to manufacturers like Taiwan Semiconductor Manufacturing Company (TSMC), which operates advanced fabrication plants to produce the chips at scale. These foundries rely heavily on equipment suppliers such as ASML, which provides the highly specialized lithography machines essential for chip production. Lithography equipment represents a significant portion of a foundry’s capital expenditure.

Last week, ASML and TSMC released their Q2 2025 earnings, offering insight into the current state of the industry.

ASML reported quarterly revenue of €7.7 billion, a 23% increase year-over-year. Its gross margin rose to 53.7%, up from 51.5% in the same period last year, while operating income surged 45% to €2.7 billion.

TSMC posted net revenue of NTD 933.8 billion (approximately USD 30.1 billion at a weighted average exchange rate of NTD 31.054 per USD), marking a 38.6% year-over-year increase. The company’s gross margin climbed to 58.6%, up from 53.2%, and operating income rose 61.7% to NTD 463 billion.

Despite their strong financial performance and interconnected business models, the market reacted differently to each company. ASML’s share price fell 8.4% over the week, while TSMC’s rose 4.3%.

ASML’s decline was largely attributed to its inability to provide guidance on whether 2026 will be a growth year, citing uncertainty around trade policies and tariffs being set by the Trump administration. This is despite TSMC’s planned $100 billion investment in the US over the next four years and the increasing demand for graphics processing units (GPUs) used in AI computers.

TSMC’s investment aims to reduce reliance on Taiwan, which faces ongoing geopolitical pressure from China, and to align more closely with U.S. policy incentives for domestic semiconductor production.

The semiconductor industry remains a critical driver of technological progress, but its future is increasingly shaped by political dynamics and global supply chain realignments.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.