Good day everyone, I trust you all had a pleasant break during the festive period. Taiwan Semiconductor Manufacturing Company (TSMC) commenced the year by announcing their results for Q4 2024.

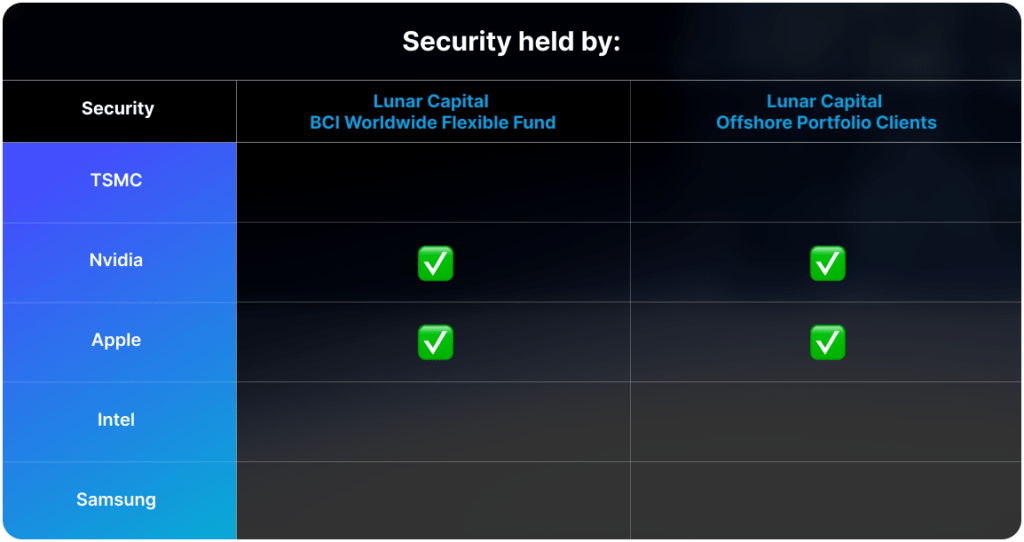

TSMC is widely regarded as one of the most crucial companies globally. While Nvidia and Apple design semiconductors for AI and phones, respectively; TSMC is the company that manufactures the semiconductors. Today, over 90% of the world’s most advanced chips are produced at TSMC’s manufacturing facilities in Taiwan.

Semiconductor designers choose TSMC for their chip production for several reasons:

- Economies of Scale: Given TSMC’s existing scale, they can accelerate chip production much faster than other companies.

- Supply Chain Resilience: TSMC has the capability to stockpile critical materials during shortages, ensuring a reliable supply chain.

- Business Model: TSMC specializes solely in semiconductor manufacturing, unlike competitors such as Intel and Samsung who also design chips. This specialization instils confidence with their clients that TSMC is not competing with them.

- Operational Excellence: TSMC’s operational expertise enables them to produce semiconductors with fewer defects, compared to their competitors. This proficiency allows TSMC to increase their margins while reducing costs for their customers.

TSMC’s revenue for the quarter was $26.9 billion, an increase of 37% compared to the previous year. This growth in revenue was primarily due to strong performance in the High Performance Computing segment and the Smartphone segment. These segments represented 53% and 35% of TSMC’s Q4 2024 revenue, respectively. As a result of the increased production scale for high-performance computing chips, TSMC’s income from operations rose by 63% year over year to $13.2 billion, indicating an operating margin of just under 50%.

Due to increasing geopolitical tensions, the United States has been encouraging TSMC to build facilities in the US by offering grants and loans. TSMC has built a factory in Phoenix, Arizona and has already started producing semiconductors from this facility. Additionally, the US has issued executive orders restricting companies from selling advanced semiconductors and semiconductor equipment to China, as both countries strive for technological leadership. Despite these measures, semiconductor designers continue to choose TSMC due to a lack of viable alternatives.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.