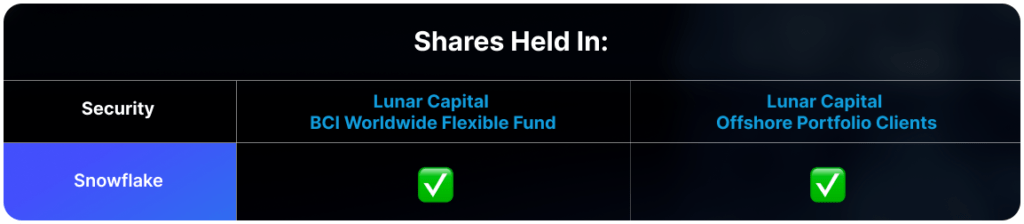

Snowflake is strategically positioned to leverage the growing importance of high-quality data in powering AI applications, including both machine learning and generative AI. The premise is simple: the better the input data, the more effective and accurate the AI output.

Snowflake enables organizations to manage and structure their data in the cloud, offering secure and efficient data querying and sharing capabilities. Snowflake has recently invested in integrating a generative AI layer into its platform. This innovation allows users to interact with their data without needing specialized coding knowledge.

In its Q2 2025 results, Snowflake reported a 28.9% year-over-year increase in revenue, reaching $869 million. However, despite this growth, the company’s gross margin declined slightly to 72%, down from 74% in the same period last year. Additionally, Snowflake recorded an operating loss of $355 million; 41% of the company’s revenue. This was marginally down from an operating loss margin of 42% last year.

One of the persistent challenges for Snowflake, as with many smaller tech companies, is the competition for top-tier talent. Unlike Big Tech with their vast financial resources, Snowflake must find alternative ways to attract and retain skilled professionals. Stock-based compensation has been a key strategy, offering equity in the company as a significant part of an employee’s compensation package. While this approach is effective in attracting talent, it comes with the risk of diluting the company’s share base, reducing each share’s claim on future earnings.

Snowflake faces the delicate balancing act of incentivizing its workforce with equity while managing the potential long-term impacts on shareholder value through dilution. Navigating this fine line is crucial for Snowflake as it continues to scale. Snowflake’s share price dropped by around 10% after the announcement of their results, reflecting shareholder’s desire to see a better balance between shareholder returns and stock-based-compensation.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.