Over the past two years, Nvidia’s stock price has increased nearly 700%, bringing its market capitalization to $2.9 trillion as of Friday. This remarkable growth has made Nvidia one of the largest companies in the world, trailing only behind industry giants like Apple and Microsoft.

Nvidia’s success is largely driven by the sale of its high-performance graphics processing units (GPUs) and AI platforms, which are crucial for training data-intensive AI workloads. As companies and organizations increasingly focus on developing artificial intelligence models, they seek processing power and energy efficiency—areas where Nvidia’s GPUs are currently unmatched in the market.

Last week, Nvidia’s Q2 2025 results were among the most anticipated of this earnings season. The company reported an impressive $30 billion in revenue for the quarter, marking a 122% year-over-year increase. Operating income also saw significant growth, rising 174% year-over-year to $18.6 billion.

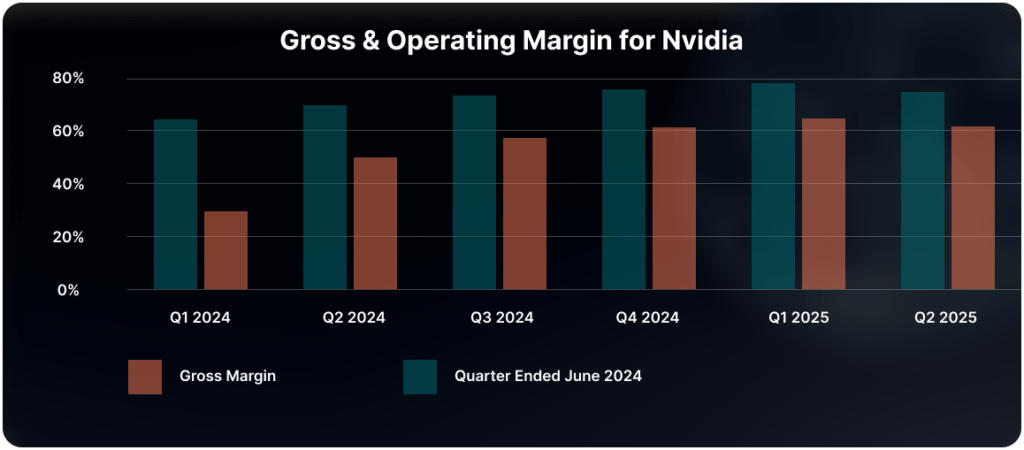

Nvidia’s gross margin came in at 75.1% for the quarter, down from 78.4% in the previous quarter but up from 70.1% in the same period last year. Despite this slight dip compared to the previous quarter, both gross and operating margins have been on a strong upward trajectory since early last year, driven by the immense demand for Nvidia’s AI platforms. The graph below shows the change in Nvidia’s margins since the beginning of last year.

The slight downturn in margins this quarter was primarily attributed to delays in the launch of their new AI platform, Blackwell, which is now expected to ship in Q4 this year. During the earnings call, CEO Jensen Huang reassured investors that Nvidia remains committed to releasing new platforms on a yearly rhythm, emphasizing the company’s focus on delivering faster and more energy-efficient chips.

Despite Nvidia’s impressive performance, several questions remain. How much additional efficiency is AI bringing to companies adopting the technology? Will the major tech players, who are heavily investing in Nvidia’s platforms, continue to spend at this rate? And could other companies be developing chips that might eventually surpass Nvidia’s offerings?

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.