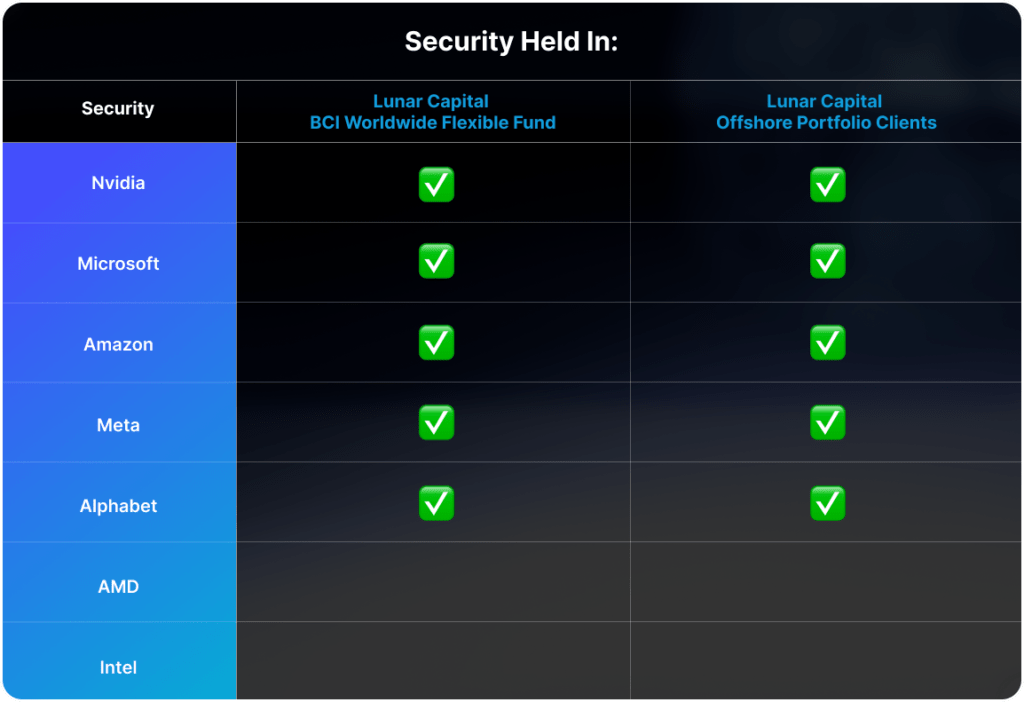

Nvidia designs state-of-the-art Graphics Processing Units (GPUs) which are among the most advanced available in the market. Their GPUs are essential for handling and processing extensive workflows required for training and operating Artificial Intelligence (AI) applications. Nvidia’s latest Blackwell chip is priced at approximately $35,000 each. These chips are primarily sold to Big Tech companies such as Google, Amazon, Microsoft, Meta, and other AI providers with the financial capacity to procure them.

Competitors like Intel and AMD have been attempting to challenge Nvidia’s dominance in the GPU market. Nvidia’s revenue for the recent quarter was $35.1 billion, an increase of 94% year over year. This growth was mainly driven by their data centre segment, which accounted for 87 percent of Nvidia’s revenue this quarter. In comparison, AMD’s data centre revenue was $3.5 billion for the quarter.

Nvidia’s customers are significantly increasing their demand for Nvidia’s chips. They are all expanding their capacity and raising their capital expenditure to build platforms for training and running models. Nvidia’s customers are determined not to fall behind in the AI industry. As it currently stands, over the next five years, Big Tech companies plan to invest over $1 trillion in AI.

The Big Tech companies are increasingly dissatisfied with the costs and “single point of failure” risk associated with Nvidia’s products. Consequently, many companies are developing their chips to reduce their dependence on Nvidia’s technology. Amazon, for instance, is planning to integrate its suite of products with Nvidia’s offerings. Unlike Nvidia’s versatile chips, Amazon’s products are designed for specific tasks, which can help lower the expenses of running certain AI applications.

Nvidia continues to hold a significant share of the market. Their operating margin for the quarter was 62%, highlighting the premium their customers are still willing to pay for their products.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.