Last week, the US Government released a list of tariffs and levies to be applied to all countries. These tariffs will range from 10% to 50% on 185 countries, significantly higher than what analysts and commentators had anticipated. The effective tariff rate, which is the customs duty revenue as a proportion of goods imported, is expected to range from 20% to 25% for 2025. The last time the effective tariff rate for the US was this high was nearly 100 years ago.

What is the USA, through the Trump presidency, trying to achieve?

Trade Balance

In 2024, the US had a trade balance (Exports – Imports) of -$1.2 trillion. US consumers have benefited from better and cheaper products from other nations, while US companies have externalized a large portion of their manufacturing to countries with a lower cost base. Big Tech companies such as Apple and Nvidia design their products in the US but outsource many components to companies like TSMC in Taiwan, which manufactures highly sophisticated semiconductors.

The intention with tariffs is to make the cost of goods imported to the US higher, which will then make manufacturing these same goods in the USA more viable. Ultimately, someone must pay the additional costs of the tariffs, and these will be consumers in the USA unless the companies selling these products absorb some these costs. Establishing complex manufacturing capabilities is not a trivial matter and could take years to do.

US Dollar as Reserve Currency

The US dollar is the world’s reserve currency. This creates a natural demand for US Dollars thus keeping its price elevated. This is a major contributor to the trade deficit in the USA, making it cheaper to import than to manufacture in the USA.

The reserve currency status of the US dollar has provided the USA with significant power over the international financial system, for example by limiting access to the international financial markets with sanctions or even through confiscating the funds of countries that it deems are enemies.

US National Debt

The US national debt reached just over $34 trillion last year, rising from $395 billion in 1924. Since the 1980s, the debt as a percentage of GDP has increased from just under 40% to over 120% in 2024. As the debt-to-GDP ratio gets higher, it becomes more challenging to pay off the debt, because the interest bill continues to take up a larger portion of the national budget.

As one would expect, the creditors of the USA, i.e. the institutions funding the USA by buying their bonds, have started expressing deeper concerns about the sustainability of this huge growth in debt.

How could you respond to this?

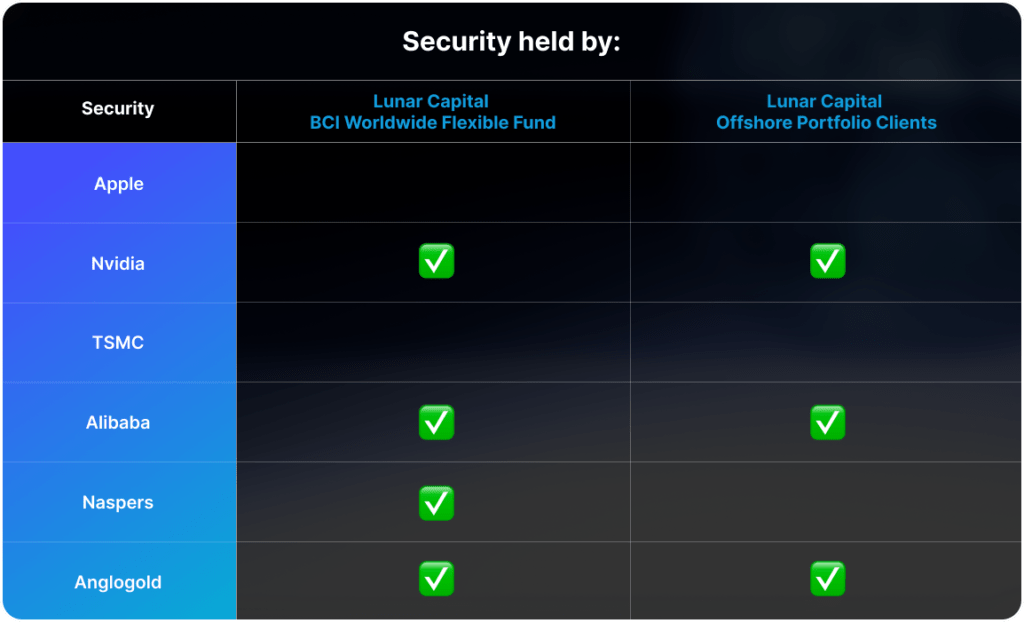

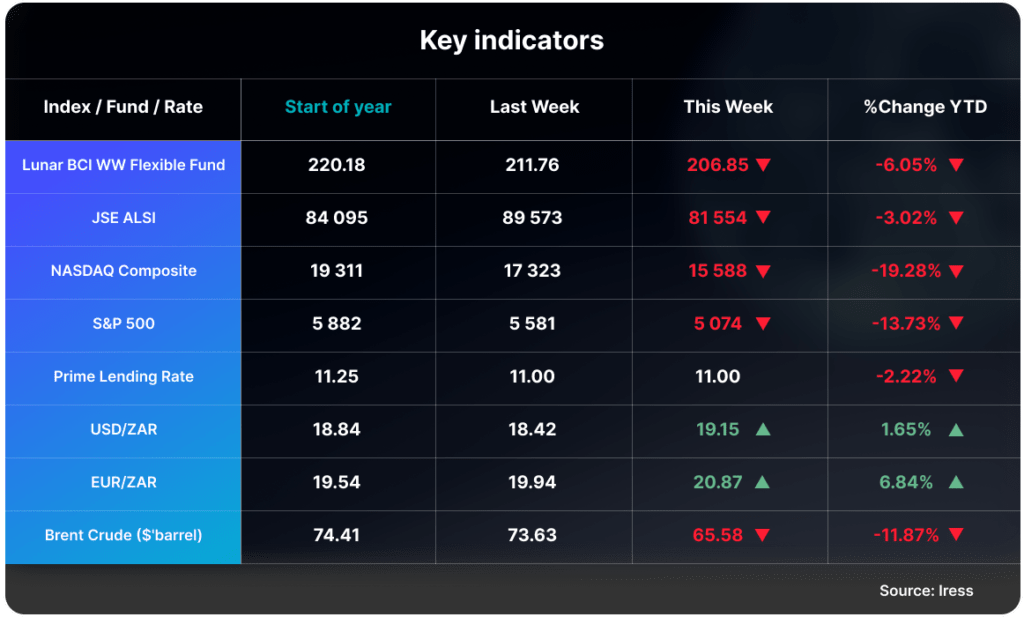

At Lunar Capital, our view was that the US markets have been over-priced since last year. We have maintained a slightly higher position in cash and have increased our exposure to businesses outside of the US, such as Alibaba, Naspers, MELI and Anglogold.

There are still high levels of uncertainty in the markets, which are been reflected in the drop in share prices and the markets around the world. At some stage, some great companies will present good buying opportunities.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.