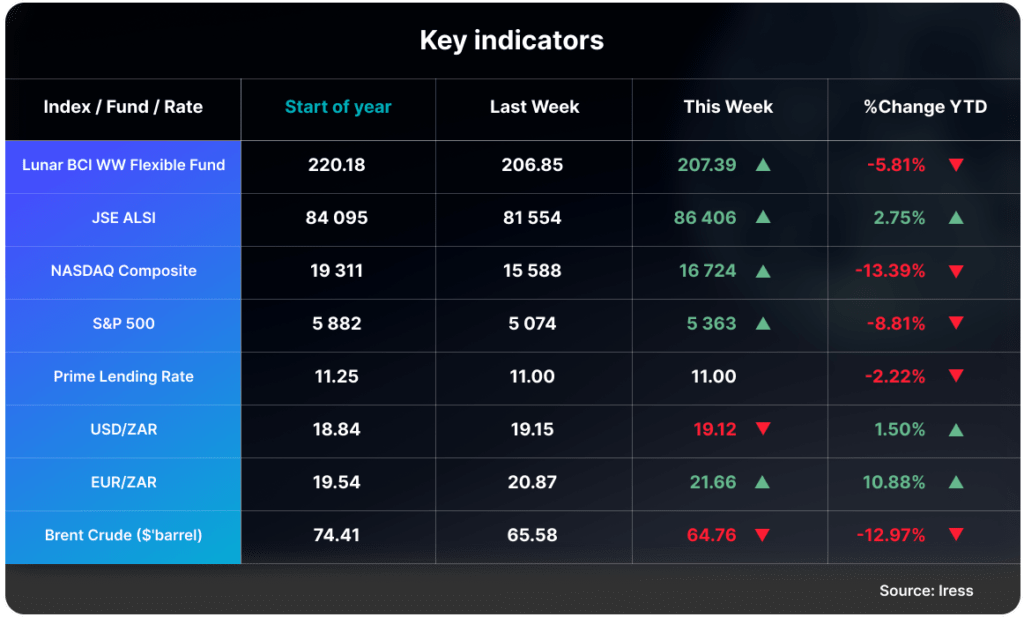

JP Morgan Chase & Co. reported their financial results for the first quarter of 2025. The company posted a revenue of $45.3 billion, marking an 8% increase year over year. Net income for the quarter reached $14.6 billion, up 9% from the same period last year. JP Morgan’s return on equity was 18% for the latest quarter. The company also reported an overhead ratio of 52% for the quarter. Despite the market volatility, JP Morgan’s share price has decreased by just under 2% since the beginning of the year.

The significant growth in revenue was primarily driven by the company’s Markets & Securities Services division, which saw a 19% increase to $10.9 billion. Notably, revenue from equity markets increased by 48% to $3.8 billion, the highest ever recorded by the company. This stand-out performance was attributed to increased market activity and trading volumes, which boosted revenue.

JP Morgan also capitalized on the increased market volatility through its derivatives business. Derivatives are financial contracts whose value is derived from the price of an underlying asset, such as stocks, bonds, or commodities. As volatility increases, the prices of the actual derivative contracts increase, and vice versa.

In his prepared remarks, CEO Jamie Dimon highlighted the dual nature of the current economic landscape. On the positive side, potential tax reforms and deregulation could provide significant benefits. However, challenges such as tariffs, trade wars, persistent inflation, high fiscal deficits, and asset price volatility remain considerable risks.

JP Morgan’s strong balance sheet continues to be a cornerstone of its stability. The company achieved a Common Equity Tier 1 (CET1) Capital ratio of 15.4%. The CET1 ratio is a measurement of a banks available capital expressed as a percentage of a bank’s risk weighted assets. The higher the CET1 ratio, the higher the loss absorbing capabilities. JP Morgan has a total loss-absorbing capacity of $558 billion.

As the global economy navigates through uncertain times, JP Morgan’s “fortress balance sheet” gives the company the potential to manage future volatility and capitalize on emerging opportunities.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.