In 2011, a 9.0 magnitude earthquake off the coast of Tohoku, Japan triggered a tsunami with waves over 15 meters high. The tsunami overwhelmed the Fukushima Daiichi Nuclear Power Plant, operated by Tokyo Electric Power Company (TEPCO), flooding critical infrastructure and disabling backup generators essential for cooling the reactors. This led to core meltdowns in three of the plant’s six reactors. A 20-kilometre exclusion zone was established around the site, and the disaster was rated Level 7 on the International Nuclear Event Scale—the highest rating, matching the severity of the Chernobyl disaster.

The immediate aftermath of Fukushima had a profound impact on the global nuclear energy landscape. Uranium prices dropped sharply as demand for enriched uranium declined.

Many countries tightened regulations around the construction of new nuclear plants, and public sentiment shifted toward caution. In the United States, only three reactors have been built since 2011. The most recent additions—two reactors in Georgia completed in 2023 and 2024—saw costs soar past $30 billion, dampening enthusiasm for future projects. Despite ambitions from the Trump administration to expand nuclear capacity, no new reactors are currently under construction in the U.S.

While the disaster initially led to a surplus of uranium in the market, that surplus is now dwindling. Supply constraints are emerging due to the high costs of developing new uranium facilities and the approaching expiration of several nuclear operating licenses over the next decade. As a result, uranium prices have been rising significantly. Technology improvements in nuclear energy reactors, using modular designs are making the lead times to develop nuclear energy plants shorter; creating additional attractiveness of nuclear energy solutions.

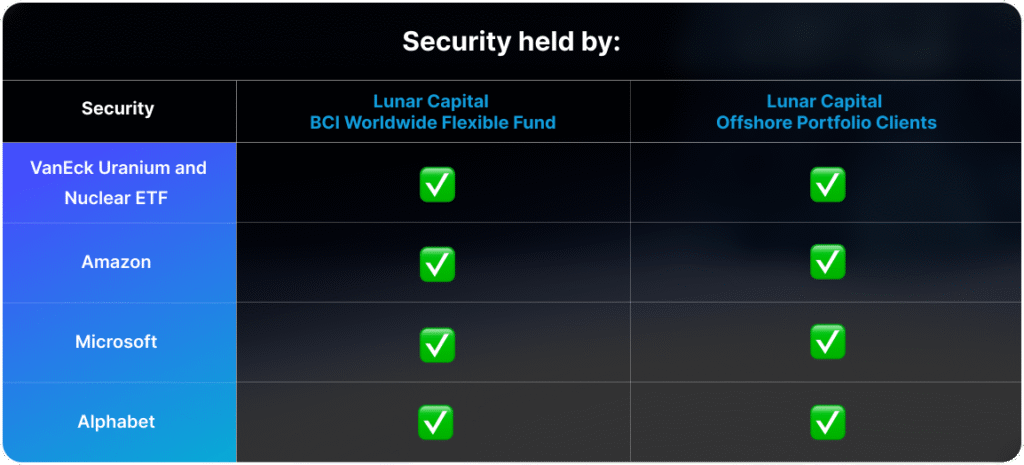

At the same time, demand for clean and stable energy sources is accelerating—particularly from Big Tech companies. Firms like Amazon, Microsoft, and Alphabet are investing heavily in AI infrastructure, which requires vast amounts of clean and stable power. To meet these needs, they’ve signed long-term agreements with nuclear power providers to supply energy to their data centres. As AI continues to expand, so too does the demand for a clean, stable energy source.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.