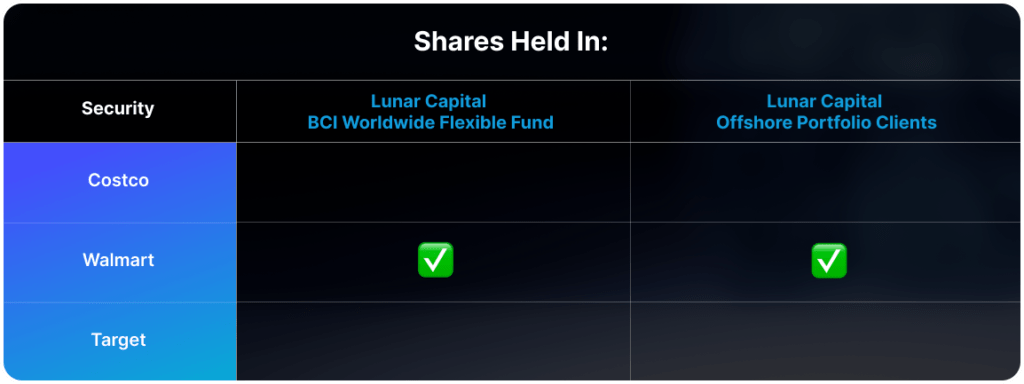

Costco has cultivated a devoted customer base in the US by appealing to price-sensitive consumers, addressing recession concerns, and focusing on selling products at lower margins than competitors. As of Friday, the retailer’s price-to-earnings (P/E) ratio was just under 60, compared to Walmart (41) and Target (16).

Over the last five years, Costco’s share price has risen by just over 200%. Examining the company’s financials, Costco reported revenue of $149 billion and a net income of $3.7 billion in 2019, resulting in a net margin of 2.5%. By 2024, the revenue grew to $253 billion, with a net income of $7.4 billion, reflecting a 2.9% margin.

In its most recent quarter, Costco achieved a gross margin of 11%. For comparison, Walmart’s latest quarter showed a net margin of 2.7% on revenue of $169 billion, with a gross margin of 25%.

Costco has managed to keep product prices low while maintaining respectable net margins through several strategies:

- Membership model: Customers must have a Costco membership to shop, encouraging repeated purchases, and allowing Costco to collect personalised client purchasing data.

- Bulk purchasing and limited selection: This approach allows Costco to negotiate lower prices and streamline inventory management, reducing costs further.

- No-frills operations: By minimizing operational expenses, Costco maintains its ability to sustain a relatively healthy margin.

Given the high P/E ratio, Costco must adhere strictly to its reputation as an “extremely well-run, no-frills business.” Notably, the company’s membership fees are nearly equivalent to its net income, indicating that membership growth is important for overall expansion. Any significant misstep by Costco could lead to a substantial decrease in its stock price.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.