Last week, TSMC (the semiconductor/chip manufacturer) and ASML (semiconductor-equipment manufacturer) released their respective Q3 2024 results. The outcomes illustrate contrasting scenarios regarding how each company is navigating the AI boom.

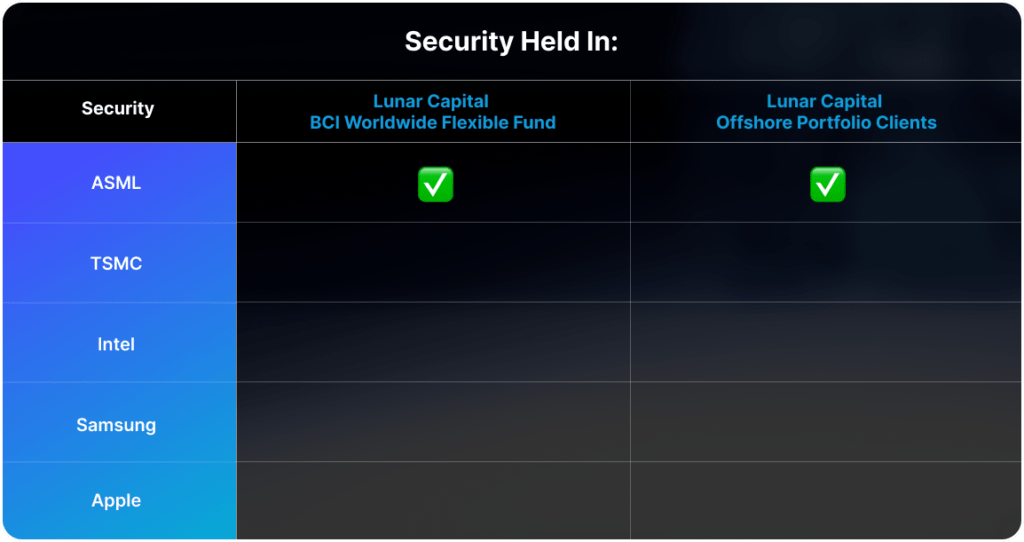

TSMC manufactures the semiconductors on behalf of companies such as Nvidia, Apple, and other designers. While ASML makes the advanced lithography machinery that is used in the process of making this machinery. It essentially uses light to etch the circuits onto the silicon to make a semiconductor. ASML sell their machinery to the semiconductor manufacturers such as TSMC, Intel, and Samsung.

For the quarter, TSMC reported a revenue of $23.5 billion, marking a 36% year-over-year increase. Their gross margin rose by 3.5 percentage points to reach 57%, and their operating profit was reported at $11.6 billion, reflecting a 58% year-over-year growth.

The surge in demand for specialized AI chips, which are critical for processing large volumes of data in AI applications, has resulted in a significant number of orders from TSMC. Notably, the high-performance computing segment grew by 11% quarter-on-quarter, accounting for 51% of TSMC’s total revenue.

It is estimated that TSMC produces 90% of the worlds super-advanced semiconductors. Intel Samsung, and other fabrication players have not been able to keep up.

In contrast, ASML recorded a revenue of €7.47 billion, representing a 10.6% year-over-year decline. Their gross margin remained stable at 50.8% compared to the same period last year, while their net income fell by 8.8% year-over-year to €2.1 billion.

ASML’s results have not correlated with TSMC’s due to delays in building new fabrication plants, particularly by Intel and Samsung. Despite grants and tax incentives from the Biden administration designed to “near-shore” semiconductor production, these delays have reduced orders for ASML’s advanced lithography machines.

Although ASML maintains an effective monopoly on the sale of advanced lithography machines, their sales can exhibit significant fluctuations due to the cyclical nature of setting up new plants, leading to considerable variability in their revenue streams.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.