Founded by Jack Ma in 1999, Alibaba was created to enable small businesses to connect with manufacturers and compete with larger enterprises on a global scale. Today, Alibaba operates a diverse range of businesses, including its business-to-business marketplace, retail marketplace, and cloud division. The company also has investments in health and media sectors.

Last week, Alibaba released its Q4 2024 results. The company reported revenue of RMB 280 billion (1 USD = RMB 7.25) for the quarter, marking an 8% year-over-year increase. Income from operations reached RMB 41 billion, up 83% year-over-year, primarily due to a decrease in impairment of intangible assets. Alibaba’s retail division remains the largest revenue generator, contributing RMB 100 billion for the quarter.

Despite the significant revenue from its marketplace, it was Alibaba’s cloud division and its commitment to investing in cloud and AI infrastructure that drove a share price increase of over 15% last week. The cloud-computing division generated RMB 32 billion in revenue last quarter, up 13% year-over-year. Additionally, Alibaba noted that its AI products and services have experienced triple-digit growth for the last six consecutive quarters, although this still represents a small portion of the company’s overall revenue. Alibaba will also benefit from Apple selecting Alibaba to develop its AI offering in the Chinese markets.

In terms of capital expenditure, Alibaba spent RMB 72 billion last year, up from RMB 24 billion the previous year. The company has expressed a strong commitment to expanding its cloud and AI infrastructure, indicating plans to spend more in the next three years than it has in the past decade on capex.

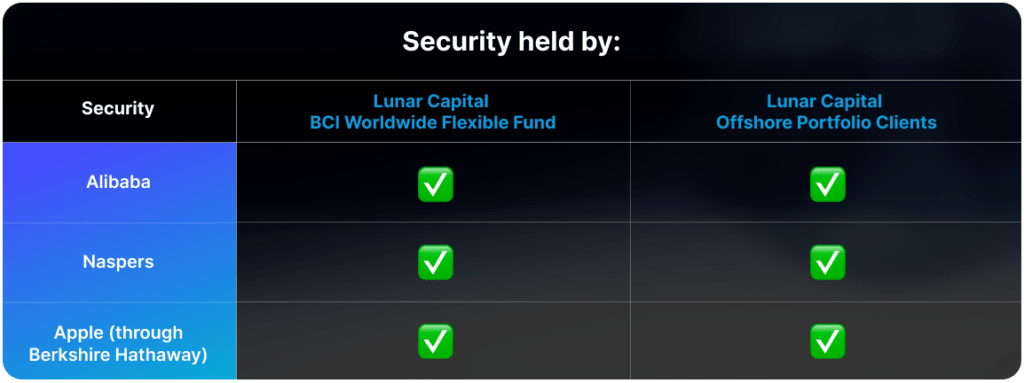

We have recently invested in Alibaba and Naspers, which holds a stake in Tencent, the largest Chinese tech company. Our view is that restrictions on advanced chip sales to China imposed by the US have spurred innovation in China by doing more with less (e.g., Deepseek). These innovations will spur further innovations and reduce the cost of AI processing.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.