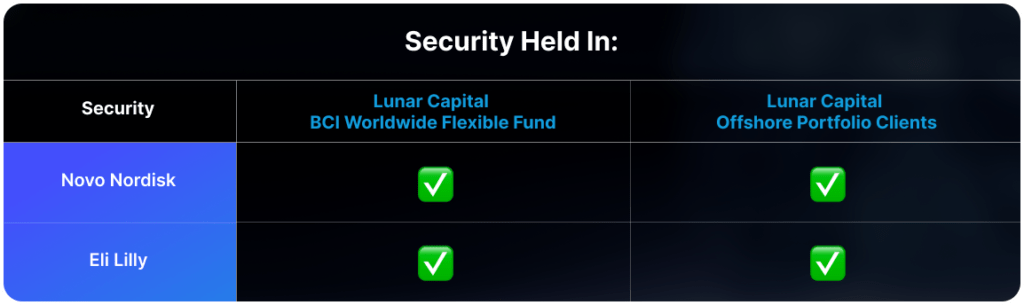

Eli Lilly and Novo Nordisk are leading pharmaceutical companies known for their innovative diabetes and obesity treatments. Both companies have developed drugs—Tirzepatide by Eli Lilly and Semaglutide by Novo Nordisk—that mimic the glucagon-like peptide-1 (GLP-1) hormone.

Originally designed for type-2 diabetes to control blood sugar by increasing insulin release, these GLP-1 drugs were later found to significantly aid in weight loss. In a recent study, Eli Lilly’s Zepbound has been shown to reduce patient weight by 21%. Associated with obesity, are a variety of other health issues – including cardiovascular diseases. Novo Nordisk’s Wegovy treatment decreased the risk of major adverse cardiovascular events by 20%.

Both Novo Nordisk and Eli Lilly are investing heavily in research and development, and in manufacturing capacity. For their recent quarter, Novo Nordisk increased their R&D spending by 127% to DKK 16.2 billion (1 USD = 6.95 DKK on 30 June 2024). This accounted for 24% of revenue, roughly in line with Eli Lilly’s R&D to revenue ratio. Both companies are pushing to gain an edge over each other and the other competitors in the industry.

The pharmaceutical industry requires extensive testing of drugs and treatments before they can be sold to patients. Some of these treatments, especially the ones related to cardiovascular diseases, can take multiple years for the treatments to be approved by the relevant authorities.

They also require large sample sizes to show the extensiveness of their research. As it stands, Novo Nordisk currently has 45000 participants in trials or about to be in trials for Semaglutide. Eli Lilly has slightly more participants in trial for Tirzepatide.

Even though other pharmaceutical companies may know how GLP-1 agonists work. They may not have the required resources in terms of capital and time to go after Novo Nordisk and Eli Lilly’s market share.

Last week, Novo Nordisk and Eli Lilly released their Q2 2024 results. Novo Nordisk’s revenue was up 25% year over year to DKK 68 billion, while net income was up only 3% to DKK 20.1 billion. This was mainly due to the increase in R&D spending. Eli Lilly on the other hand had revenues of $11.3 billion, up 36% year over year. Its net income increased 68% to $3 billion. this was primarily driven by increased manufacturing capacity and pricing power.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.