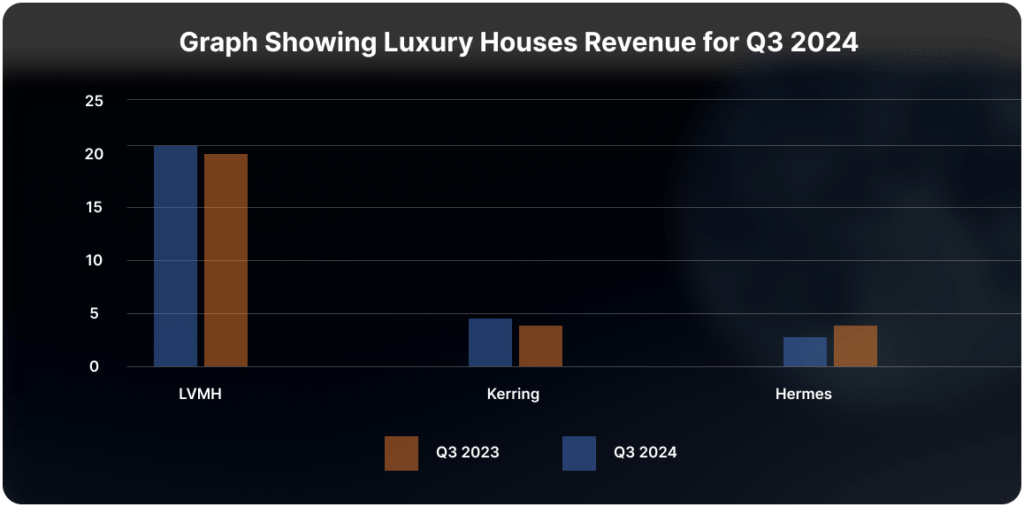

Over the last two weeks, luxury fashion houses LVMH, Kering, and Hermes released their revenue figures for the third quarter. The companies reported weaker demand from various regions around the world as consumers show less inclination to purchase luxury items during tighter economic conditions and rising costs. Consumers are more selective with their purchases. The graph below shows the revenue for Q3 2023 compared to Q3 2024 from these luxury houses.

LVMH oversees numerous luxury brands, including Louis Vuitton, Christian Dior, Moet & Chandon, Hennessy, and Sephora. The company’s revenue dipped by 4%, mainly due to declines in its Wine and Spirits and Fashion and Luxury segments. It was partially offset by a rise in its Perfume and Cosmetics segment. The company operates globally, with an expanding presence in Asia. The depreciation of the Japanese Yen has led to consumers purchasing more in Japan, making Japan one of LVMH’s best-performing regions this year.

Kering, which owns Gucci and Yves Saint Laurent, has a more concentrated portfolio than LVMH. Gucci made up over 40% of Kering’s revenue this quarter but saw a 26% sales drop from the same quarter last year. Facing macroeconomic challenges and a lack of consumer resonance with their products, Kering has changed Gucci’s leadership to try to revitalize the brand. Overall, Kering’s sales declined 15% year over year.

Hermes, which has an even tighter portfolio, has experienced significant growth in the luxury sector in recent years. It has seen its sales this quarter increase by 10% year over year. The company targets ultra-high-net-worth individuals. Some bags sold by Hermes have year-long waitlists and can be priced around ten thousand euros. The company strategically limits the number of items sold to create higher demand for its products.

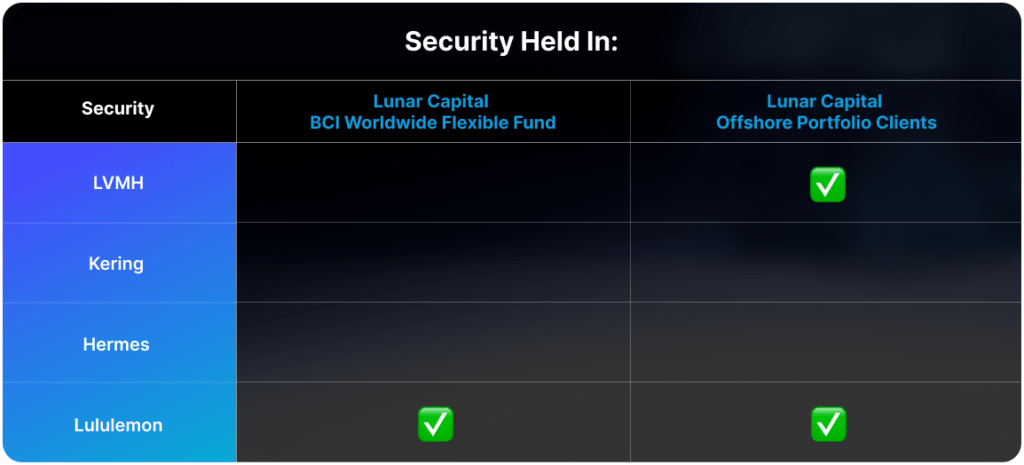

Consumer preferences can be unpredictable, significantly impacting the success of companies. Luxury brands not only compete with each other, but also compete with athleisure brands like Lululemon, which traditionally were not considered direct competitors.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.