According to the World Health Organization, global life expectancy at birth reached 73.3 years in 2024, an increase of 8.4 years since 1995. This steady rise reflects significant progress in social, economic, and healthcare development across the world, with mortality rates declining especially among older adults. At the same time, many people, particularly in developed nations, are choosing to have fewer children: contributing to an increase in the median age of the global population.

At Lunar Capital, we believe that this trend will continue. Medical innovation is accelerating, and more research is being directed toward living healthier, longer lives. As people live longer, new patterns of demand begin to emerge, reshaping industries and creating opportunities for businesses that can meet the evolving needs of an aging population.

One of the most immediate consequences of increased longevity is the rising demand for healthcare services. This includes not only medical treatments but also assisted living facilities, wellness programs, and technologies that support aging in place. As people seek a better quality of life in their later years, the healthcare sector will adapt and expand to meet these expectations. Lunar is invested in Novo Nordisk and Eli Lilly that not only have diabetes and obesity treatments but also a number of other treatments that cater for aging related health conditions.

Equally important is the growing need for financial management services. Living longer means individuals must plan for extended retirement periods, which come with higher lifetime expenses. Wealth management, retirement planning, and financial advisory services are becoming essential tools to help people navigate the financial complexities of aging. This shift presents a compelling investment opportunity in companies that provide these services.

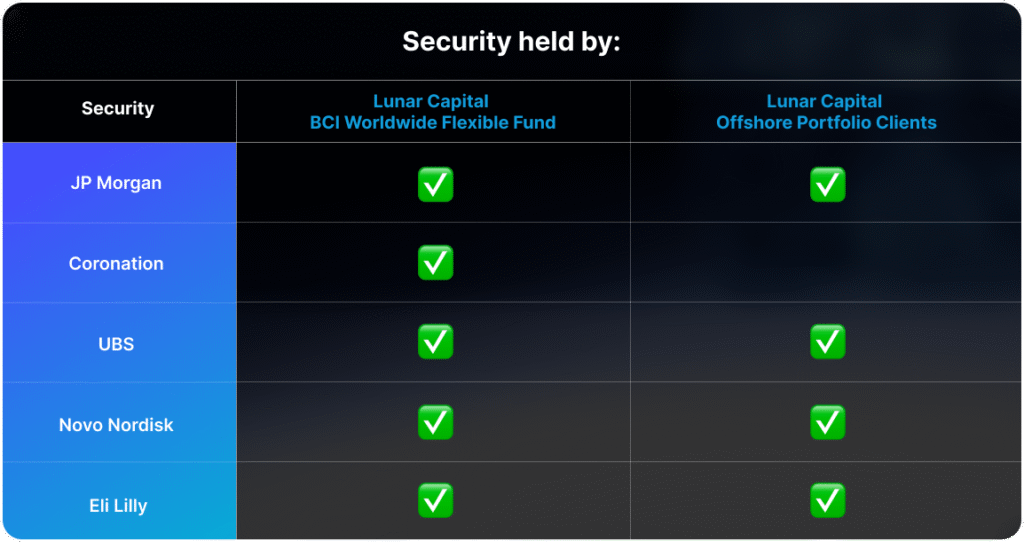

Within the Lunar Capital BCI Worldwide Flexible Fund, we hold three businesses that are well-positioned to benefit from this demographic trend: JP Morgan, Coronation Fund Managers, and UBS.

JP Morgan offers a wide range of wealth management and retirement solutions tailored to long-term financial planning. Coronation Fund Managers has a variety of funds that are invested globally. UBS, a global leader in private banking, provides comprehensive wealth advisory services for individuals planning for multi-decade retirements.

At Lunar Capital, we remain committed to identifying global themes like aging demographics and investing in businesses that are poised to thrive in this evolving landscape.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.