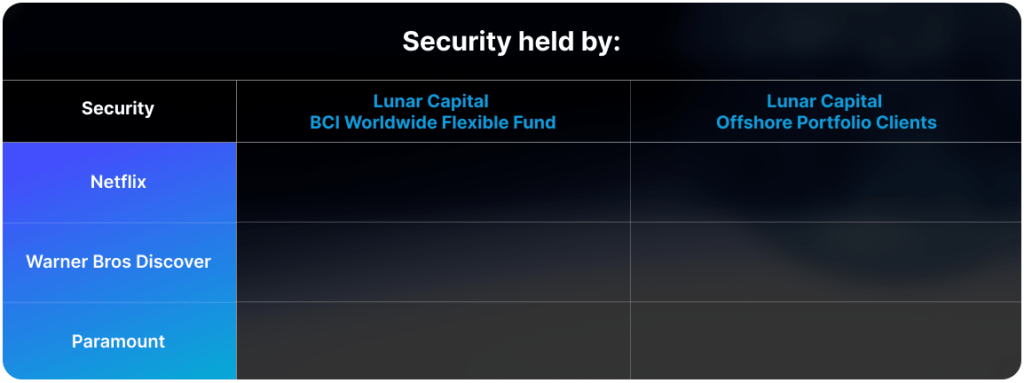

Before Paramount’s interest in Warner Bros Discovery (WBD) surfaced in September 2025, WBD was trading on the NASDAQ at a market capitalization of roughly $30 billion. Since then, its valuation has steadily climbed to over $60 billion in December as multiple companies joined the race to acquire WBD’s core assets.

On Friday, Netflix, with a market cap of just over $400 bn, agreed to purchase significant portions of WBD, including its film studio and streaming service HBO Max, along with the associated intellectual property (IP). Notable IP includes Game of Thrones, the Sopranos, Harry Potter, and Friends. Netflix is excluding WBD’s linear (i.e. traditional TZ, broadcast business) network assets from the deal. The offer values WBD shares at $27.75 each, translating to an equity value of $72 billion and a total enterprise value of $82.7 billion. (Enterprise value accounts for both market capitalization and net debt.)

For the past 12 months, WBD generated $19.6 billion in revenue from its core assets, excluding linear networks. Netflix is paying just over four times that annual revenue. Profitability, however, is a concern: WBD posted an operating margin of only 1.5%, compared to Netflix’s 29.1% on $43.4 billion in revenue. Although WBD’s market cap is much smaller than Netflix’s, it still reported 128 million subscribers at the end of its most recent quarter. In comparison, Netflix ended last year with just over 300 million subscribers.

These dynamics raise critical questions:

- Will WBD’s IP migrate to Netflix’s platform, or remain on HBO Max?

- If integrated, how many additional subscribers could Netflix attract?

- Can Netflix justify raising prices, and will consumers accept higher costs?

- Will Netflix achieve operational efficiencies and bring WBD’s assets closer to its own profitability model?

Meanwhile, Paramount (backed by Larry Ellison of Oracle and a few other players) is attempting to disrupt the process. On Monday, December 8, the company submitted a direct offer to WBD shareholders for $108 billion. This is striking given Paramount’s market cap of roughly $15 billion. Funding such a deal would require issuing debt or equity far exceeding its current valuation, introducing significant risk.

Historically, media acquisitions have often ended poorly for buyers. The ultimate success of these deals will hinge on two factors: the price paid and how effectively the acquired assets are integrated. Profitability and operational efficiency will determine whether these transactions create long-term value; or become yet another cautionary tale in the media industry.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.