Despite a growing number of consumers, particularly Millennials and Gen Z, gravitating toward athleisure over traditional luxury items; companies in the space continue to face challenges in building sustainable, long-term brands and businesses. Consumers are notoriously fickle, with preferences that shift rapidly and unpredictably. The market is saturated with fashion brands catering to various tastes, price points, and styles – making customer loyalty difficult to maintain.

Last week, Nike released its Q1 2026 financial results. Total revenue for the quarter was $11.7 billion, a modest 1% increase year over year. Revenue from wholesale partners rose 7% to $6.8 billion, while Nike Direct revenue declined 4% to $4.5 billion. Gross margin fell to 42.2%, down 320 basis points from the previous year, and income before taxes dropped 29% to $922 million.

Nike’s profitability declined more sharply than revenue due to rising costs (both in cost of sales and operations) outpacing revenue growth. This phenomenon, known as operational gearing, has been exacerbated by tariffs on imports to the U.S. For the current fiscal year, Nike expects these tariffs to increase costs by $1.5 billion.

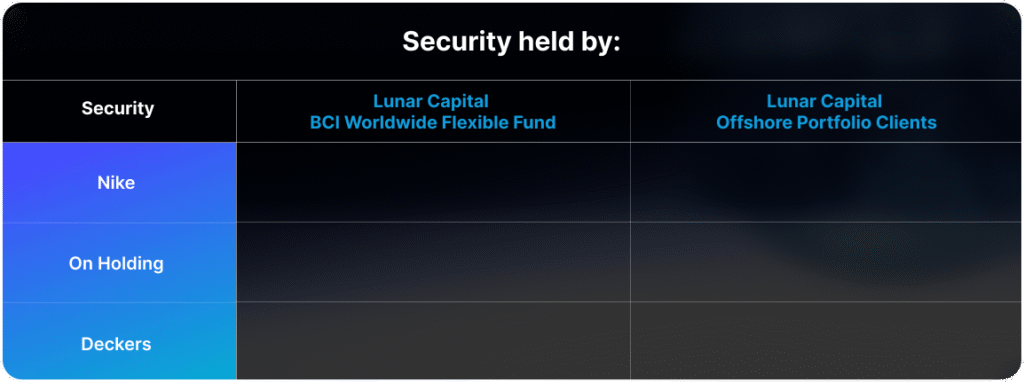

These additional tariffs come at a difficult time for Nike, as it is in the midst of a strategic turnaround, aiming to win back customers who have found better-suited products from competitors. Brands like On Holdings and Hoka (owned by Deckers) have been gaining market share, particularly in the running category. Their smaller, more focused operations have recently allowed them to respond more nimbly to consumer trends resulting in relatively higher growth rates.

Nike continues to target a broad range of income levels across global markets. However, it is facing headwinds as consumers, especially in the U.S. and China, grapple with reduced disposable income. Encouragingly, Nike’s renewed focus on performance sportswear is beginning to show promise. Its running division grew 20% year over year, benefiting from strong tailwinds in the category.

Despite macroeconomic pressures and competitive threats, Nike maintains a solid financial foundation. With over $7 billion in cash and a long-term debt-to-equity ratio of 78%, the company is better-positioned to weather economic challenges.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.