The Land Question?

In my opinion, the Land Question in South Africa raises a broader issue. It is the question of retribution for the crimes of colonialism and Apartheid. The Black Economic Empowerment policies attempted to address these issues but these have fallen short of meaningful empowerment of the previously disenfranchised. It has also had unintended consequences – […]

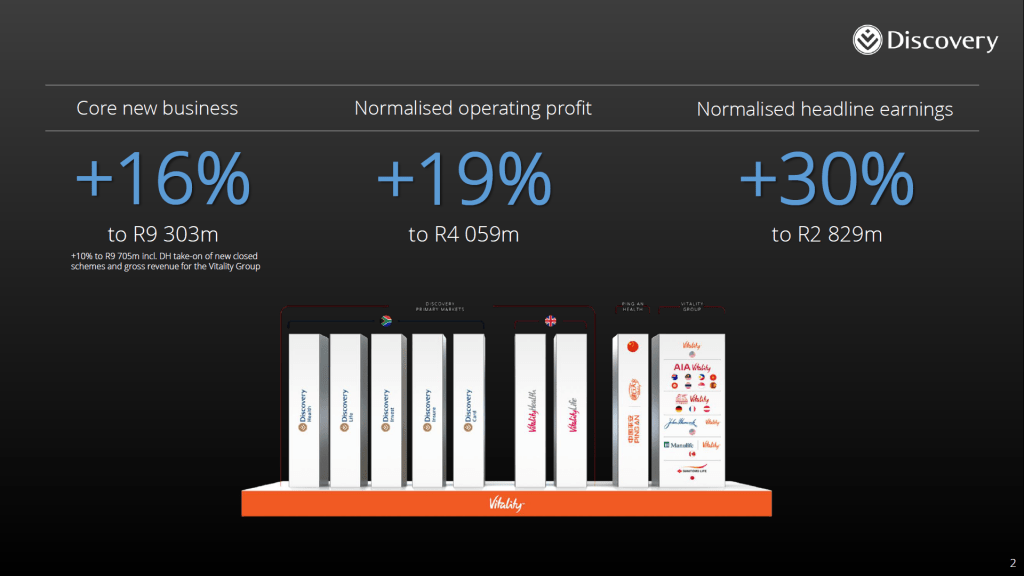

Share Focus: Discovery

[fusion_builder_container hundred_percent=\”no\” equal_height_columns=\”no\” menu_anchor=\”\” hide_on_mobile=\”small-visibility,medium-visibility,large-visibility\” class=\”\” id=\”\” background_color=\”\” background_image=\”\” background_position=\”center center\” background_repeat=\”no-repeat\” fade=\”no\” background_parallax=\”none\” parallax_speed=\”0.3\” video_mp4=\”\” video_webm=\”\” video_ogv=\”\” video_url=\”\” video_aspect_ratio=\”16:9\” video_loop=\”yes\” video_mute=\”yes\” overlay_color=\”\” video_preview_image=\”\” border_size=\”\” border_color=\”\” border_style=\”solid\” padding_top=\”\” padding_bottom=\”\” padding_left=\”\” padding_right=\”\”][fusion_builder_row][fusion_builder_column type=\”1_1\” layout=\”1_1\” background_position=\”left top\” background_color=\”\” border_size=\”\” border_color=\”\” border_style=\”solid\” border_position=\”all\” spacing=\”yes\” background_image=\”\” background_repeat=\”no-repeat\” padding=\”\” margin_top=\”0px\” margin_bottom=\”0px\” class=\”\” id=\”\” animation_type=\”\” animation_speed=\”0.3\” animation_direction=\”left\” hide_on_mobile=\”small-visibility,medium-visibility,large-visibility\” center_content=\”no\” last=\”no\” min_height=\”\” […]

Goals Conceded, Saved, Missed and Scored

[fusion_builder_container hundred_percent=\”no\” equal_height_columns=\”no\” menu_anchor=\”\” hide_on_mobile=\”small-visibility,medium-visibility,large-visibility\” class=\”\” id=\”\” background_color=\”\” background_image=\”\” background_position=\”center center\” background_repeat=\”no-repeat\” fade=\”no\” background_parallax=\”none\” parallax_speed=\”0.3\” video_mp4=\”\” video_webm=\”\” video_ogv=\”\” video_url=\”\” video_aspect_ratio=\”16:9\” video_loop=\”yes\” video_mute=\”yes\” overlay_color=\”\” video_preview_image=\”\” border_size=\”\” border_color=\”\” border_style=\”solid\” padding_top=\”\” padding_bottom=\”\” padding_left=\”\” padding_right=\”\”][fusion_builder_row][fusion_builder_column type=\”1_1\” layout=\”1_1\” background_position=\”left top\” background_color=\”\” border_size=\”\” border_color=\”\” border_style=\”solid\” border_position=\”all\” spacing=\”yes\” background_image=\”\” background_repeat=\”no-repeat\” padding=\”\” margin_top=\”0px\” margin_bottom=\”0px\” class=\”\” id=\”\” animation_type=\”\” animation_speed=\”0.3\” animation_direction=\”left\” hide_on_mobile=\”small-visibility,medium-visibility,large-visibility\” center_content=\”no\” last=\”no\” min_height=\”\” […]

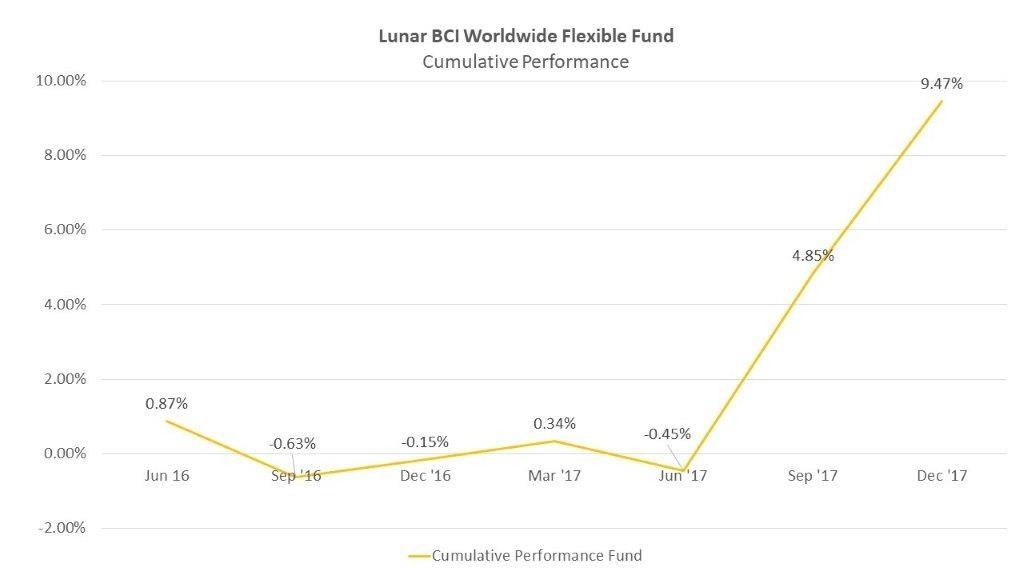

Lunar BCI Worldwide Flexible Fund End of Year 2017 Report

Market Overview The calendar year 2017 was another roller-coaster year for the investment markets in South Africa and globally. Some of the more significant events include: Ratings agencies downgraded South African sovereign debt to junk status, citing political and economic risks facing the country; Serious allegations of mismanagement and corruption in state-owned enterprises, including Eskom, […]

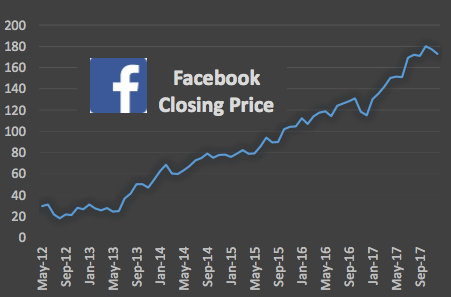

Share Focus: Facebook

[fusion_builder_container hundred_percent=\”no\” equal_height_columns=\”no\” menu_anchor=\”\” hide_on_mobile=\”small-visibility,medium-visibility,large-visibility\” class=\”\” id=\”\” background_color=\”\” background_image=\”\” background_position=\”center center\” background_repeat=\”no-repeat\” fade=\”no\” background_parallax=\”none\” parallax_speed=\”0.3\” video_mp4=\”\” video_webm=\”\” video_ogv=\”\” video_url=\”\” video_aspect_ratio=\”16:9\” video_loop=\”yes\” video_mute=\”yes\” overlay_color=\”\” video_preview_image=\”\” border_size=\”\” border_color=\”\” border_style=\”solid\” padding_top=\”\” padding_bottom=\”\” padding_left=\”\” padding_right=\”\”][fusion_builder_row][fusion_builder_column type=\”1_1\” layout=\”1_1\” background_position=\”left top\” background_color=\”\” border_size=\”\” border_color=\”\” border_style=\”solid\” border_position=\”all\” spacing=\”yes\” background_image=\”\” background_repeat=\”no-repeat\” padding=\”\” margin_top=\”0px\” margin_bottom=\”0px\” class=\”\” id=\”\” animation_type=\”\” animation_speed=\”0.3\” animation_direction=\”left\” hide_on_mobile=\”small-visibility,medium-visibility,large-visibility\” center_content=\”no\” last=\”no\” min_height=\”\” […]

Delaying Gratification

[fusion_builder_container hundred_percent=\”no\” equal_height_columns=\”no\” menu_anchor=\”\” hide_on_mobile=\”small-visibility,medium-visibility,large-visibility\” class=\”\” id=\”\” background_color=\”\” background_image=\”\” background_position=\”center center\” background_repeat=\”no-repeat\” fade=\”no\” background_parallax=\”none\” parallax_speed=\”0.3\” video_mp4=\”\” video_webm=\”\” video_ogv=\”\” video_url=\”\” video_aspect_ratio=\”16:9\” video_loop=\”yes\” video_mute=\”yes\” overlay_color=\”\” video_preview_image=\”\” border_size=\”\” border_color=\”\” border_style=\”solid\” padding_top=\”\” padding_bottom=\”\” padding_left=\”\” padding_right=\”\”][fusion_builder_row][fusion_builder_column type=\”1_1\” layout=\”1_1\” background_position=\”left top\” background_color=\”\” border_size=\”\” border_color=\”\” border_style=\”solid\” border_position=\”all\” spacing=\”yes\” background_image=\”\” background_repeat=\”no-repeat\” padding=\”\” margin_top=\”0px\” margin_bottom=\”0px\” class=\”\” id=\”\” animation_type=\”\” animation_speed=\”0.3\” animation_direction=\”left\” hide_on_mobile=\”small-visibility,medium-visibility,large-visibility\” center_content=\”no\” last=\”no\” min_height=\”\” […]

Share Focus: Stadio BEE Offer

[fusion_builder_container hundred_percent=\”no\” equal_height_columns=\”no\” hide_on_mobile=\”small-visibility,medium-visibility,large-visibility\” background_position=\”center center\” background_repeat=\”no-repeat\” fade=\”no\” background_parallax=\”none\” parallax_speed=\”0.3\” video_aspect_ratio=\”16:9\” video_loop=\”yes\” video_mute=\”yes\” overlay_opacity=\”0.5\” border_style=\”solid\”][fusion_builder_row][fusion_builder_column type=\”1_1\” layout=\”1_1\” background_position=\”left top\” background_color=\”\” border_size=\”\” border_color=\”\” border_style=\”solid\” border_position=\”all\” spacing=\”yes\” background_image=\”\” background_repeat=\”no-repeat\” padding=\”\” margin_top=\”0px\” margin_bottom=\”0px\” class=\”\” id=\”\” animation_type=\”\” animation_speed=\”0.3\” animation_direction=\”left\” hide_on_mobile=\”small-visibility,medium-visibility,large-visibility\” center_content=\”no\” last=\”no\” min_height=\”\” hover_type=\”none\” link=\”\”][fusion_text] Stadio (SDO) recently unbundled from Curro, which is part of the PSG family. Stadio […]

Thinking about my biggest investing mistakes

Shhh.. As the Naspers (NPN) share price keeps on powering ahead, I can’t help thinking why did I ever sell the Naspers I bought for my wife’s portfolio a few years back (Shhh.. please don’t tell her). In 2010, I bought some Naspers for my wife’s account for around R298 per share. Within a period […]

Interview with Sabir Munshi on what is Bitcoin and what the future may hold for Bitcoin

[fusion_builder_container hundred_percent=\”no\” equal_height_columns=\”no\” hide_on_mobile=\”small-visibility,medium-visibility,large-visibility\” background_position=\”center center\” background_repeat=\”no-repeat\” fade=\”no\” background_parallax=\”none\” parallax_speed=\”0.3\” video_aspect_ratio=\”16:9\” video_loop=\”yes\” video_mute=\”yes\” overlay_opacity=\”0.5\” border_style=\”solid\”][fusion_builder_row][fusion_builder_column type=\”1_1\” layout=\”1_1\” background_position=\”left top\” background_color=\”\” border_size=\”\” border_color=\”\” border_style=\”solid\” border_position=\”all\” spacing=\”yes\” background_image=\”\” background_repeat=\”no-repeat\” padding=\”\” margin_top=\”0px\” margin_bottom=\”0px\” class=\”\” id=\”\” animation_type=\”\” animation_speed=\”0.3\” animation_direction=\”left\” hide_on_mobile=\”small-visibility,medium-visibility,large-visibility\” center_content=\”no\” last=\”no\” min_height=\”\” hover_type=\”none\” link=\”\”][fusion_text] Sabir Munshi Director at Lunar Capital talks Salaamedias listeners through a number of questions […]

Second-Level Thinking

The best investors in the world have a great ability to look and think beyond the obvious. This characteristic is referred to as second-level thinking. In second-level thinking, one has to go beyond the obvious cause-and-effect type thinking. It requires one to ask deeper questions, like “So, What?” and “Could there be more complex dynamics […]