Before Walmart released its Q2 2026 results last week, the company was trading at a price-to-earnings (PE) ratio of just under 42 before the release of their results. This means that, based on current earnings, it would take an investor 42 years to recoup their investment. A high PE ratio can signal several things:

- Strong Growth Expectations: Investors may be pricing in rapid future earnings growth and are willing to pay a premium today for the promise of higher returns tomorrow.

- Economic Moat: Companies with durable competitive advantages often command higher valuations due to their resilience in downturns and ability to fend off competitors.

- Market Inefficiency: Sometimes, a high PE reflects short-term market exuberance rather than fundamental value, indicating a potential disconnect between price and performance.

In Walmart’s Q2 2026 results, the company reported total revenue of $177.4 billion, up 4.8% year-over-year. However, operating income declined by 2.4% to $7.3 billion, largely due to insurance claims, litigation costs, and restructuring expenses. This resulted in an operating margin of just 4.2%.

Walmart’s core strategy revolves around offering everyday low prices, with groceries accounting for approximately 60% of U.S. sales. This positions the company defensively, as food is a non-discretionary purchase. In contrast, general merchandise sales – more susceptible to economic cycles – can be postponed by consumers.

The company has also been expanding its e-commerce capabilities, particularly through its “order and pickup” model. Walmart noted gains in market share across all income segments, with notable traction among higher-income consumers seeking value.

However, looming tariff uncertainties and the complexity of their technology and e-commerce implementation pose risks. While Walmart’s scale allows it to absorb some of these costs better than smaller competitors, the path to further market share growth remains challenging.

While Walmart benefits from a strong brand, defensive product mix, and growing e-commerce presence, its earnings growth does not currently justify a PE ratio of 42. Operating income growth is low, margins remain thin, and macroeconomic headwinds like tariffs could further pressure profitability. Unless Walmart can significantly accelerate earnings growth or improve margins, its PE ratio is likely too high relative to its fundamentals.

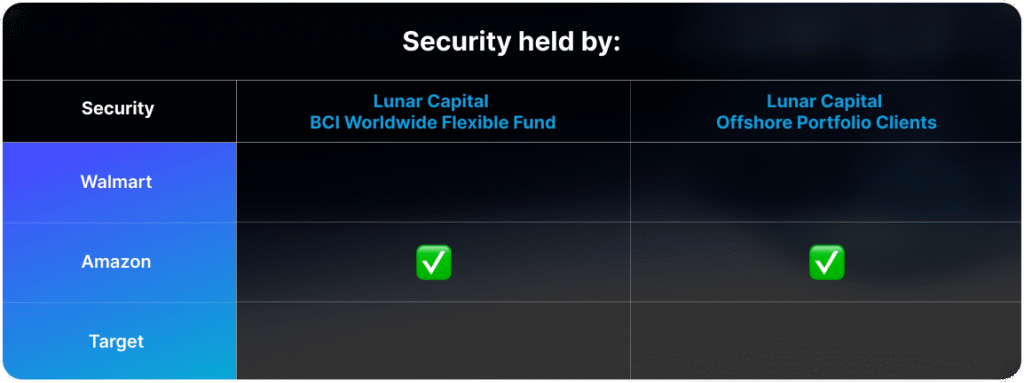

Following a sustained increase in Walmart’s share price over the last 3 years, and given its elevated price, we made the decision to sell our holdings in the company.

Click here to access your account to view statements, obtain tax certificates, add or make changes to your investments.

Our email address is: [email protected]

Disclosures

Lunar Capital (Pty) Ltd is a registered Financial Services Provider. FSP (46567)

Read our full Disclosure statement: https://lunarcapital.co.za/disclosures/

Our Privacy Notice: https://lunarcapital.co.za/privacy-policy/

The Lunar BCI Worldwide Flexible Fund Fact Sheet can be read here.

This stocktake is prepared for the clients of Lunar Capital (Pty) Ltd. This stocktake does not constitute financial advice and is generated for information purposes only.